Xi Jinping’s crackdown on perceived threats to national security is roiling the vast industry of consultants and researchers who help global investors understand China, threatening the government’s attempts to lure foreign capital into an economy showing increasing signs of strain.

The latest and most prominent target is Capvision Pro Corp., a global expert network headquartered in Shanghai and New York. Chinese authorities on Tuesday accused the firm of leaking state secrets and being linked to foreign intelligence agencies. In a rare occurrence involving a foreign company, China’s state television on Monday night broadcast footage of officials raiding Capvision’s offices, questioning employees and removing equipment.

The move, which came weeks after authorities interrogated staff at the China offices of US consultancy Bain & Company and targeted New York-based due-diligence enterprise Mintz Group, is part of an anti-espionage crackdown on consulting firms, according to state media.

“Independent research firms and consultants that are from unfriendly countries seem to be the target here,” said Kerry Goh, chief investment officer at Kamet Capital Partners Pte. “Most hedge funds use a variety of research firms like Capvision.”

While some investors say they can turn to other channels to get information about Chinese companies, the environment is becoming increasingly challenging for businesses that provide such services. The head of one China-focused investment advisory firm, which is a client of Capvision, said they are considering shutting down their operations due to the risk of their staff being detained. The person asked not to be identified because of the sensitivity of the matter.

Balance Interests

President Xi’s administration is seeking to balance protecting national security with a goal of encouraging foreign investment. The government is taking steps to tighten control over sensitive data, especially in the wake of US sanctions targeting important industries such as chipmaking and given the risk of new sanctions over its support for Russia.

Capvision worked on projects from overseas companies with close ties to foreign governments, and military and intelligence agencies, according to a report shared on Tuesday by the Central Political and Legal Affairs Commission.

China Makes Capvision First Public Target in Anti-Spy Push: Q&A

Capvision, founded in 2006, said in a statement posted to its WeChat account on Monday that it would uphold national security policies and play a leading role in the healthy development of the consulting industry. Bloomberg calls and emails to Capvision on Tuesday were not returned. It has more than 2,000 clients include hedge funds, management consulting firms and multinational companies, according to its website.

In another example of tougher regulation, Chinese financial data providers recently stopped providing detailed information on the nation’s companies to overseas clients.

Police Raids

Since the US expanded curbs on China’s access to semiconductor technology in October, Beijing has taken its “obsession with secrecy” to a new level, according to Gregory Allen, senior fellow in the strategic tech program at the Center for Strategic and International Studies, a Washington think tank.

“The most dramatic examples of this are the police raids on international consulting and due diligence firms operating in China, but it extends to every organization that is trying to collect the data that corporations and governments need in order to do business in China and with China,” Allen said.

China Restricts Overseas Access to Key Corporate Information

China continues to push for more investment after its reopening from Covid Zero. Premier Li Qiang — the country’s No. 2 behind Xi — vowed in March to establish a “broad space” for international companies to develop there. China has welcomed a host of leaders and business delegations, including from Germany and France. Last month, China’s Politburo urged greater efforts at boosting foreign investment.

Economic Woes

“I wonder if the left hand knows what the right hand wants,” said Joerg Wuttke, head of the European Union Chamber of Commerce in China. “Does China want more foreign investment or are they content with unnerving the foreign business community with actions that are not explained or understood by us?”

Recent data shows China’s economy, hit badly by shutdowns during the pandemic, could do with more support. Data released Tuesday showed imports dropped 7.9% in April, much worse than the median projection of a 0.2% decline, while export growth slowed to 8.5% from double digits in March.

“Areas across China are saying ‘we want to increase new investment, we need new investment’” said Noah Fraser, Canada China Business Council managing director. “But the business landscape is becoming less investable.”

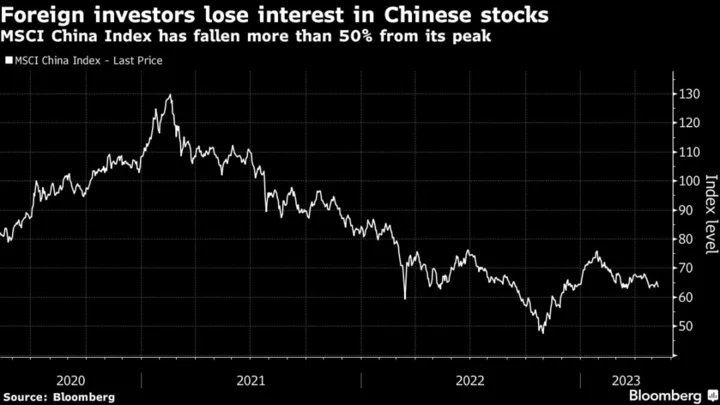

Global investors are souring on the nation’s stocks, with a revival after the country emerged from Covid Zero proving shortlived. The MSCI China Index slumped 2% on Tuesday, taking its decline from a January high to 16%. Compared with its peak in 2021, the gauge is down more than 50%.

“The market is keenly aware of increasing restrictions on information flows,” said Brock Silvers, managing director at private equity firm Kaiyuan Capital Ltd. “Perhaps authorities doubt the resolve of foreign investors to act on investability concerns, or they may see China’s economy as having outgrown its prior reliance on foreign capital. If we continue on the current path, both ideas may eventually be proven incorrect.”

Darkening Gloom in Chinese Stocks Puzzles Wall Street Veterans

Trips to China to meet local businesses and do research are off the table for some, cutting off another channel.

“The arrests have many foreign investors worried about visiting China and employing Chinese nationals to conduct market research,” Anne Stevenson-Yang, a long-time China watcher and co-founder of J Capital Research Ltd., wrote in a note dated Tuesday. “Several large asset managers, for example, have developed internal “no fly” policies to keep staff from visiting China.”

Diplomats Expelled

The external environment doesn’t suggest the elevated paranoia will abate any time soon. On Tuesday alone, China warned the European Union against sanctioning its companies, while German Chancellor Olaf Scholz accused China of increasingly acting as a rival to the EU rather than a partner. Beijing ordered a Canadian diplomat to leave the country, in a tit-for-tat move hours after Prime Minister Justin Trudeau’s government expelled a Chinese envoy from his nation.

For Stevenson-Yang, recent events suggest a permanent shift.

“China’s recent hostility toward any independent reporting on the economy demonstrates that the old China, of openness to foreign investment and cheery growth are things of the past,” she wrote.

--With assistance from Xiao Zibang, Ishika Mookerjee, Rebecca Choong Wilkins, Lorretta Chen, James Mayger, Sarah Zheng, Sofia Horta e Costa, Jill Disis, Colum Murphy and Lucille Liu.