WeWork Inc. is already infamous for torching billions of Softbank Group Inc.’s cash. It’s been labeled a poster child for the excesses of Silicon Valley’s founder worship. And exemplifies the profligacy of a near-zero interest rate environment.

Now — after the office-sharing company said is has “substantial doubt” that it can remain solvent — it’s one of the biggest failures of a stock-market trend littered with blowups: SPAC-mania.

In October 2021, WeWork — then private — merged with a special purpose acquisition company that raised a whopping $1.3 billion from investors and gave it a $9 billion valuation. That placed it among the ten largest SPAC deals by enterprise value at the time with a private investment in public equity, or PIPE, that counted investors like Insight Partners, funds managed by Starwood Capital Group, and Fidelity Management among those buying in.

Now, WeWork is a penny stock worth a paltry $340 million.

“It’s the most high-profile de-SPAC flop,” said Julian Klymochko, chief executive officer of Accelerate Financial Technologies, which has a SPAC-focused fund. The company was in a tough spot before the merger “which was certainly a plan B if not a plan C — as the valuation had already dropped more than 75% since its private funding,” he added.

The company was given a $47 billion valuation from SoftBank in 2019 when the startup was the apple of Wall Street’s eye and plotting a massive initial public offering. Now, it’s not sure it will be around this time next year.

WeWork joins the 127 de-SPACs — which are companies that merged with a blank check firm — to flag questions about their own viability as going concerns this year, a signal they could go out of business. That’s according to Bedrock AI, an investment research company that scours regulatory documents. The firm says the percentage of de-SPACs raising concerns over the past four years was nearly double those that went public via more traditional vehicles.

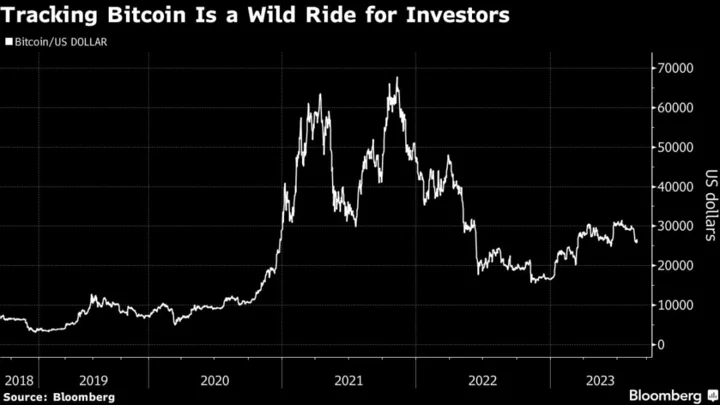

That means if WeWork can’t turn its business fortunes around or get rescue funding, it’s at risk of joining the more than 15 de-SPACs to go bust. The stock has crashed 98% from the 2021 debut as it wiped out more than $8 billion in value, mostly hitting those PIPE investors and holders of the private company.

To be fair, it’s not the SPAC product’s fault. The company’s business model has been plagued by issues ranging from the impact of the Covid-19 pandemic to a carousel of leaders. Now, WeWork’s implosion is drawing comparisons to some of the SPAC era’s biggest flops.

Billionaire Richard Branson’s space-launch company Virgin Orbit Holdings Inc. is another de-SPAC blow-up that comes to mind for Klymochko. The company filed for bankruptcy in April after going public in the final days of 2021 with a more than $3 billion valuation.

The SPAC mania resulted in a range of companies spiraling from their debut with more than one-fifth of the stocks that went public trading for less than $1. That’s not to mention those that have gone bankrupt or were acquired at fire-sale prices. Companies like Core Scientific Inc., one of the largest Bitcoin miners, and online retail startup Enjoy Technology Inc. went bust after less than a year on public exchanges.

--With assistance from Jeremy Hill.