Investors are watching Washington with a keen eye as President Joe Biden prepares to host House Speaker Kevin McCarthy and other congressional leaders at the White House on Tuesday in a bid to resolve the ongoing impasse over the US debt ceiling and avoid a potentially catastrophic technical default.

Treasury-bill markets have started to factor in the risks of non-payment from next month onward after both Treasury Secretary Janet Yellen and the non-partisan Congressional Budget Office warned last week that there’s a risk the government could exhaust borrowing capacity as soon as early June. The cost of insuring against a US default through derivatives has also rocketed higher in recent weeks.

But the broader market impact of debt-cap concerns has remained relatively muted, with stock and bond investors having been more focused on recession risks, Federal Reserve policy and concerns about the health of America’s regional banks.

Yellen said Sunday there are “simply no good options” for solving the debt-limit stalemate in Washington other than Congress lifting the cap. She also cautioned that invoking the 14th Amendment — which states that the validity of US debt shall not be questioned and is seen by some as invalidating the concept of the debt ceiling — would provoke a constitutional crisis.

Senate Republican leader Mitch McConnell warned he won’t come to Biden’s rescue by breaking the partisan deadlock, saying there’s no “ secret plan” and the White House has to figure it out with Speaker McCarthy.

Meanwhile, former Biden administration economic adviser Daleep Singh said a financial-market shock is what’s required to motivate politicians to break the current impasse on the debt limit.

From Washington to Wall Street, here’s what to watch to gauge how worried observers should be and when they should be concerned.

X-Date Predictions

Underpinning the various moves in debt markets are differing estimates about when the government might exhaust its options to fund itself — commonly referred to as the X-date. While the administration itself has provided guidance that it might fall short as soon as June, prognosticators across Wall Street have also been busy running the numbers based on government cash flows and expectations around tax and spending. Some strategists have pulled forward their estimates to align more with forecasts out of Washington. Others, meanwhile, are staying with their late-summer estimate, although recent cash flows from the Treasury suggest that it’s even more uncertain whether it will make it until June 15, a key tax payment day.

Related story on Yellen’s warning to Congress about hitting the limit

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasury securities --and potential dislocations that show up. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time Uncle Sam might be at risk of default and right now that’s most prominent around early June. The government on Monday sold $57 billion of three-month securities — that are scheduled to mature on Aug. 10 — at 5.14%. That’s the highest auction yield for that particular benchmark bill since January 2001.

Those kind of yields are, of course, tempting for investors who reckon such a premium is unwarranted because the debt-cap impasse will be resolved. Bill Gross, the former chief investment officer at Pacific Investment Management Co., is one individual in that camp, recommending that investors buy short-term T-bills in anticipation of an eventual resolution.

Related story on Bill Gross talking about buying T-bills

The Cash Balance

The US government’s ability to pay its debts and meet its spending obligations ultimately comes down to whether it has the cash to do it, so the amount sitting in its checking account is crucial. That figure ebbs and flows from day to day depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. And if it gets too close to zero for the Treasury department’s comfort that could be a problem.

MLIV Pulse Survey: Are the odds of a US default this time higher than in 2011? Share your views here.

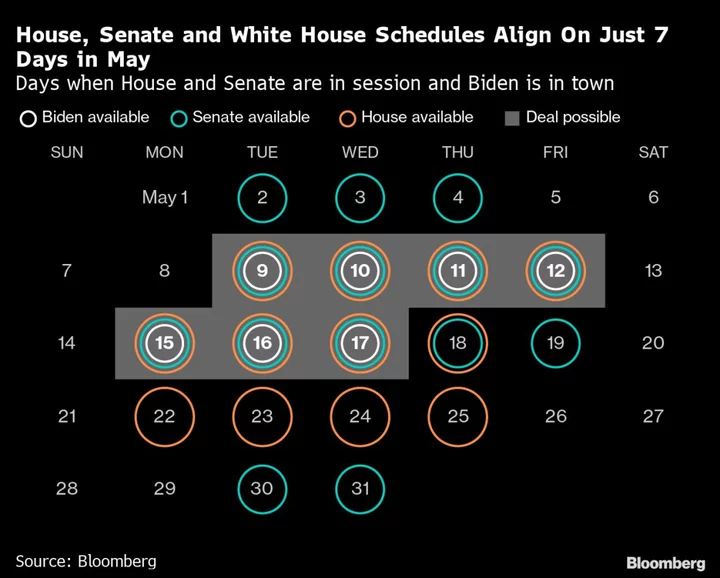

Congress

Ultimately, some of the most important numbers in this whole saga relate to the amount of votes that can be secured in Washington to get a deal done. That will be driven, in large part, by the willingness of key government leaders to hammer out an agreement. Following is a glance at just how small the window might be for them to bridge the gap and come to an agreement.