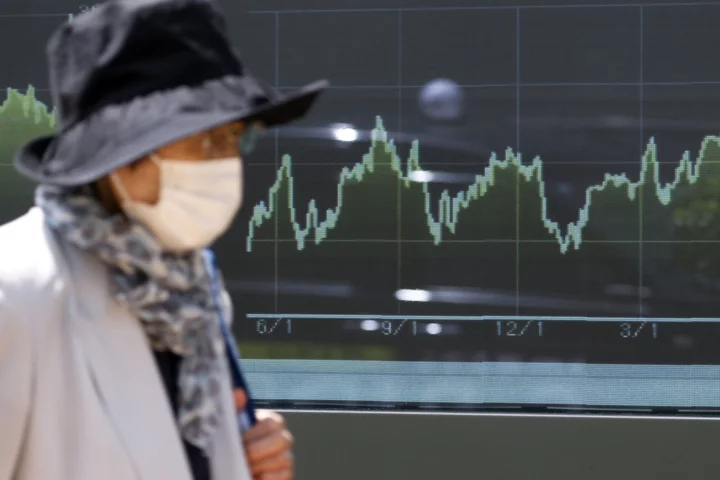

The surge in Japanese stocks to more than 30-year highs this week has been accompanied by an unusual phenomenon: a spike in volatility.

The Nikkei Volatility Index — which like the CBOE VIX is based on options prices — climbed to as high as 22.48 from 15.78 a week ago. The rise comes amid a wave of short-covering by players who did not foresee the market’s strong rally.

“There are probably many investors who didn’t expect Japanese stocks to rise this much near term, and are buying back call options now,” said Masanari Takada, derivatives strategist at JPMorgan Securities Japan Co. “The latest rally in the Nikkei has been quite big, so some investors could be buying put options for downside hedges as well.”

Volatility indexes tend to rise the most when the underlying market is tanking because swings tend to be bigger when prices are falling. The Japanese measure’s latest jump suggests investors who bet against this week’s rally in the Nikkei 225 above 30,000 and sold calls at that level are now covering such positions.

Large open interest remains in Nikkei call options with strike prices of 31,000 to 33,000, data compiled by Bloomberg show, suggesting the potential for more volatility ahead.

--With assistance from Aya Wagatsuma.