US stock futures advanced as appetite for risk taking returned to global markets following the deal between President Joe Biden and House Speaker Kevin McCarthy on the US debt ceiling.

Contracts for the S&P 500 and Nasdaq 100 both gained about 0.5% as trading opened in Asia on Monday. Gold inched lower while oil and Bitcoin moved higher, reflecting the more buoyant tone.

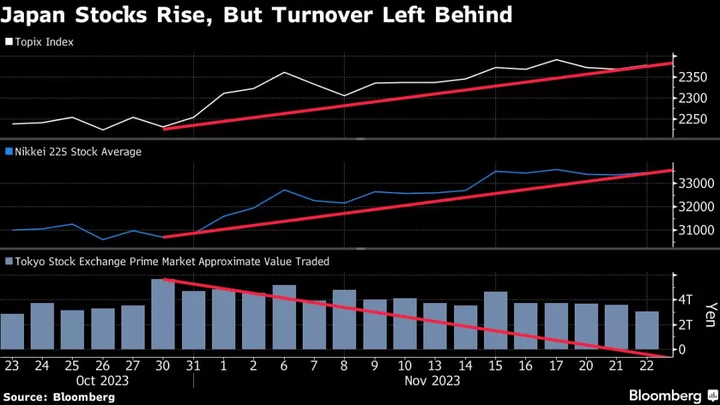

Futures for benchmarks in Japan and Australia pointed upward and a gauge of US-listed Chinese stocks rallied Friday in a positive sign for Hong Kong traders returning from a long weekend.

Moves in currency markets were muted, with the dollar trading in tight ranges of about 0.1% versus most of its major counterparts after reaching a two month high earlier last week.

Investors had become increasingly confident on Friday that an agreement would be struck in Washington, supporting gains in the US equity benchmarks. Shares there also continued to be led higher by tech stocks and the frenzy surrounding artificial intelligence.

Investors were demanding less of a premium to hold US Treasury bills on Friday that were seen most at risk of nonpayment if a deal isn’t reached in time. US markets are closed Monday for a holiday, as are those in the UK and some parts of Europe.

“The obvious positive interpretation is that a negative tail risk is close to being taken off the table,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors, “With the distraction of the debt ceiling fading into the background, investors can now refocus their attention on the underlying fundamentals. One concern, though, is that the fundamental picture remains precarious.”

The agreement struck by Biden and McCarthy over the weekend needs to be passed by Congress, with the clock ticking down on June 5, when Treasury Secretary Janet Yellen has said cash will run out. There is plenty in the deal that Democrats and Republicans won’t like.

The bond market also has much to contend with. The Treasury will need to replenish is coffers by selling more debt and the passing of the deal puts focus back on the Federal Reserve’s fight to tame inflation.

“Uncertainty persists regarding the duration and severity of the ongoing earnings recession, and perversely, the near-term tightening of liquidity may worsen due to the government’s need to address its debt issuance backlog,” said Suzuki. “While the markets managed to avert an immediate crisis, the coast is far from all-clear just yet.”

The rate-sensitive two-year Treasury drifted Friday as traders considered how a debt agreement could play into the Fed’s path forward on interest rates. The two-year yield hovered around 4.65% after a report on consumer spending showed the Fed still has more work to do to bring inflation back toward its target. The personal consumption expenditures price index, one of the Fed’s preferred inflation gauges, rose by a faster-than-expected 0.4% in April.

In stocks Friday, the S&P 500 rose 1.3% and the tech-heavy Nasdaq 100 added 2.6% as Marvell Technology Inc. said 2024 revenues would “at least double” from a year ago on a surge in demand from AI, echoing sentiments from rival chipmaker Nvidia Corp. earlier in the week.

Elsewhere, there will be heightened interest in emerging markets after Turkish President Recep Tayyip Erdogan sealed an election victory, raising the prospect of more friction with Western governments and more uncertainty for investors.

Key events this week:

- US Memorial Day holiday. UK and some European markets also closed for holidays, Monday

- Eurozone economic confidence, consumer confidence, Tuesday

- US consumer confidence, Tuesday

- Richmond Fed President Thomas Barkin interviewed by NABE as part of monetary policy webinar series, Tuesday

- China manufacturing PMI, non-manufacturing PMI, Wednesday

- US job openings, Wednesday

- Fed issues Beige Book economic survey, Wednesday

- Philadelphia Fed President Patrick Harker has fireside chat on the global macro-economy and monetary conditions, Wednesday

- Boston Fed President Susan Collins and Fed Governor Michelle Bowman speak in Boston, Wednesday.

- ECB issues financial stability review, Wednesday

- China Caixin manufacturing PMI, Thursday

- Eurozone HCOB Eurozone Manufacturing PMI, CPI, unemployment, Thursday

- US construction spending, initial jobless claims, ISM Manufacturing, light vehicle sales, Thursday

- ECB issues report its May 3-4 monetary policy meeting. ECB President Christine Lagarde speaks at German savings banks conference, Thursday

- Philadelphia Fed President Patrick Harker speaks on economic outlook at NABE’s webinar, Thursday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures 0.4% as of 8:05 a.m. Tokyo time. The S&P 500 rose 1.3% Friday

- Nasdaq 100 futures rose 0.6%. The Nasdaq 100 rose 2.6%

- Nikkei 225 futures rose 1.5%

- Australia’s S&P/ASX 200 Index futures rose 1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0720

- The Japanese yen fell 0.1% to 140.80 per dollar

- The offshore yuan was little changed at 7.0743 per dollar

- The Australian dollar was little changed at $0.6522

Cryptocurrencies

- Bitcoin rose 2% to $28,112.59

- Ether rose 3% to $1,909.27

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.80%

- Australia’s 10-year yield declined one basis point to 3.72%

Commodities

- West Texas Intermediate crude rose 0.7% to $73.16 a barrel

- Spot gold fell 0.2% to $1,943.54 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee.