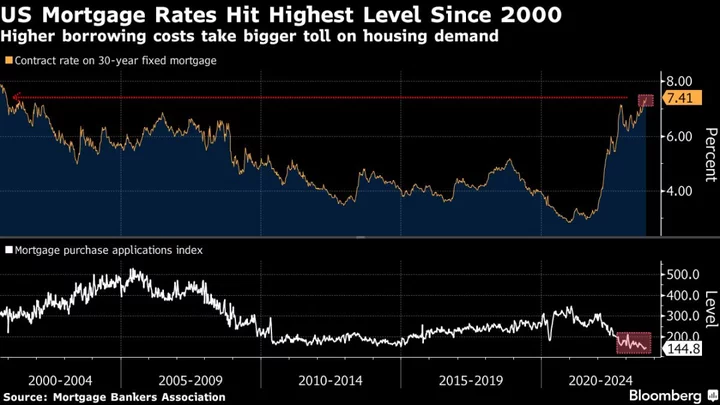

US mortgage rates jumped last week to the highest level since 2000, taking a toll on already depressed home-purchase applications.

The contract rate on a 30-year fixed mortgage rose 10 basis points to 7.41% in the week ended Sept. 22, according to Mortgage Bankers Association data out Wednesday. As a result, the index of home-purchase applications fell to 144.8, one of the lowest readings in decades.

The latest pickup in borrowing costs is making the housing market — already one of the least affordable on record — even worse. Despite elevated financing costs, home prices continue to rise amid the limited supply of homes for sale.

Part of the reason for that lean inventory is because many homeowners don’t want to move in the current high-rate environment. Moving would cause them to lose the lower mortgage rate they locked in years prior.

Builders have stepped in to replenish housing inventories and have been offering incentives to attract prospective buyers to the new construction market. But there’s only so much demand they can attract when borrowing costs are so high.

The overall measure of mortgage applications, which includes refinancing activity, also declined.

Mortgage rates are unlikely to show any improvement in the near future. Federal Reserve Chair Jerome Powell stressed last week that the central bank will keep borrowing costs elevated — and could possibly bump them even higher — if inflation fails to recede back toward its 2% target.

The survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data cover more than 75% of all retail residential mortgage applications in the US.

(Adds graphic)