Bankers and investors are optimistic that a string of initial public offerings will cap off a quiet year for new issuance before things accelerate in 2024.

That’s the consensus across Wall Street after a flurry of deals on US exchanges positioned September to be the biggest month for IPO fundraising since the market essentially shut in January 2022, according to data compiled by Bloomberg. Even though Arm Holdings Plc and Instacart stumbled in the days following their debuts, their recent stability is giving confidence to firms in the country — and around the world — that have been waiting for their chance.

Companies listing on US exchanges have raised roughly $7.2 billion so far in September, accounting for 56% of the cash raised in global IPOs that priced this month, data compiled by Bloomberg show. While Arm accounts for nearly $4 of every $10 raised this month, a boost in activity around the world suggests a broad-based thawing of conditions, so long as central banks don’t get in the way.

“If a stable rate environment persists then 2023 will bring the establishment of a solid IPO market and 2024 could open the floodgates,” said Rainmaker Securities managing director Greg Martin.

US Reopens

US listings are perking up heading into the final three months of the year. The $21.4 billion raised in 2023 through Wednesday is just a bit less than the amount seen in the same stretch last year, and a growing number of companies plan to test the waters.

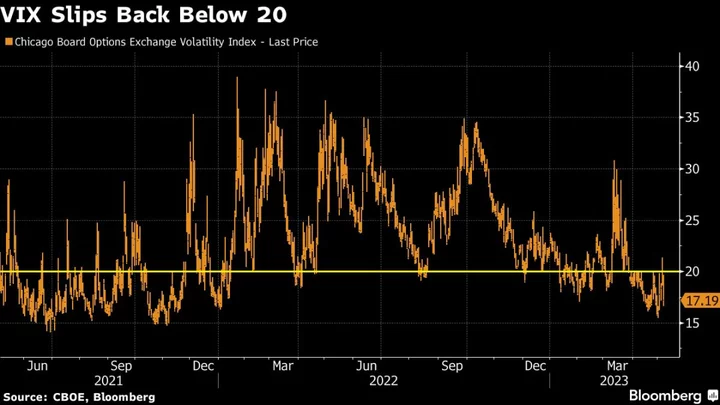

It’s a stark contrast to earlier this year with volatility staying low as investors get more comfortable that the Federal Reserve’s interest rate hiking campaign is nearing its end. The VIX Index has broadly held below 20 since late March — a key level for bankers seeking a less volatile equity market for pricing stock offerings — while the benchmark S&P 500 Index is up 11% this year.

“A lot of it will take place in 2024 in terms of companies actually pulling the trigger on IPOs, but we’re seeing a lot of companies preparing to go, and monitoring market conditions,” said Stellar Tucker, head of technology corporate and investment banking at Truist Securities. “I feel like we’re turning the corner and I very much look forward to the next 12 to 18 months.”

Some IPO candidates may decide to go ahead even if conditions are less than perfect. The time elapsed since private companies’ last fundraising is on average about 18 months, according to John Collmer, Citigroup Inc.’s global head of private capital markets.

“Many companies are starting to kind of get to that pivotal point where they need to raise capital, in the public or private market,” Collmer said.

The follow-through in the days and weeks after strong opening pops has been uneven. Klaviyo Inc. has rallied 14% since its debut, and just four of the 16 companies to raise more than $300 million this year on US exchanges are trading lower than their IPO prices. Still, Arm and Instacart’s performances were disappointing at first, giving back most of their initial gains.

“The trading outcomes for these IPOs is not what anyone expected, but it has nothing to do with the quality of the order books and the demand,” said Matthew Wolfe, head of technology and consumer equity capital markets at Piper Sandler Cos. “If you take a step back and look at the performance across three very different, very good businesses, along with what has happened with the broader indexes and things like this week’s Fed takeaways, you can infer that this is more about a temporary macro-level headwind.”

Europe Heats Up But Still Slow

First-time share sales in the rest of the world have been downright anemic, leaving bankers with time to look for signs of optimism. With just $16.3 billion raised in Europe, the Middle East and Africa IPOs this year, it’s set to be the worst showing since 2012, according to data compiled by Bloomberg.

Activity across the region is showing signs of life, however. There has been a slew of announcements, including Germany’s Schott AG looking to raise as much as €813 million ($859 million) from an IPO of its specialty medical-glassware division, Schott Pharma AG. CVC Capital Partners is gearing up for a potential listing as soon as November which could be among the buyout industry’s biggest ever in Europe, Bloomberg News reported.

“2023 was never going to be a waterfall of issuance, more a slow and gradual reopening led by some high quality assets,” said James Palmer, head of EMEA ECM at Bank of America Corp. “The short term performance of global IPOs will not serve to disrupt what is already a train in motion for 2024, when activity is likely to be more broad-based.”

“Arm was an important test and in Europe a number of deals are going through smoothly,” said Thomas Feuerstein, co-head of equity capital markets for France, Belgium and Luxembourg at Societe Generale SA.

“I wouldn’t say there is a pipeline per say of IPOs waiting to happen but a lot of companies are now ready to hit the button and go ahead should the environment be favorable,” Feuerstein added.

Middle Eastern firms are already racing out of the gate. Saudi Arabia’s Lumi Rental Co. surged as much as 30% in its trading debut Monday after a 1.09 billion riyal ($291 million) IPO, while oil driller ADES Holding Co. priced its $1.2 billion IPO at the top of the range.

Asia Looks to 2024

Bankers in Asia Pacific have more or less resigned themselves to annual IPO volume falling to the lowest figure in a decade, as geopolitical tension and a slowing economy sent China shares plunging. Even a trickle of successful listings would help revive animal spirits for 2024. Seven companies are expected to start trading in Hong Kong before the end of September, all raising less than $200 million each.

“Seems like other than the AI companies coming to market, those from other sectors are still trying to push through even with smaller floats,” said Ethan Aw, an analyst at Aequitas Research who publishes on Smartkarma.

The brightest hope for larger deals may be logistics companies like SF Holding Co., which could raise $2 billion to $3 billion in a Hong Kong listing, people familiar with the matter said in May. J&T Global Express Ltd. is seeking approval as soon as next week for an IPO in the city that may raise about $500 million.

Alibaba Group Holding Ltd.’s logistics arm filed Tuesday for a Hong Kong listing that may raise at least $1 billion. With the Chinese giant’s five other units also set to potentially land on Asian exchanges, part of a radical revamp announced in March, whichever is the first is guaranteed to be closely watched.

--With assistance from Blaise Robinson, Julien Ponthus, Julia Fioretti and Alexandra Muller.

Author: Bailey Lipschultz, Amy Or and Filipe Pacheco