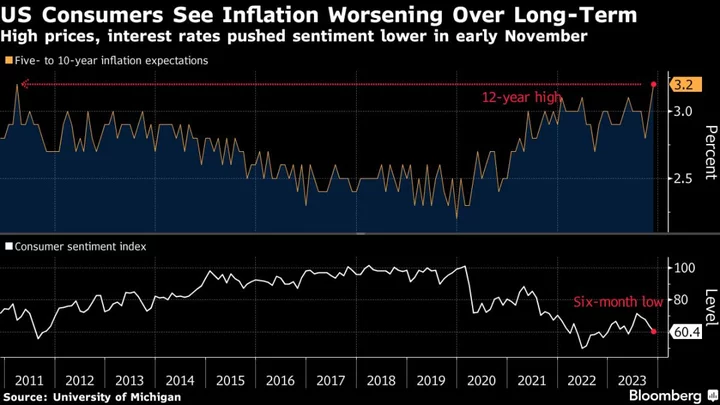

US consumers’ long-term inflation expectations increased to the highest since 2011, while concerns about high borrowing costs and the economy’s prospects mounted in a fresh blow to sentiment in early November.

Consumers expect prices will climb at an annual rate of 3.2% over the next five to 10 years, up from 3% a month earlier, according to the preliminary November reading from the University of Michigan. They see costs rising 4.4% over the next year, compared to last month’s 4.2%, according to data released Friday.

The report showed expectations for gasoline prices over the short and long run increased to the highest this year. That’s at odds with the current trend in prices at the pump, which have steadily fallen since late September.

The university’s consumer sentiment index slid to a six-month low of 60.4, weaker than all estimates in a Bloomberg survey of economists. While Americans were slightly more upbeat about their finances, measures of buying conditions and the economic outlook deteriorated.

“The combination of expectations for persistently high prices, high borrowing costs, and labor market weakness does not bode well for the prospect of continued strength in consumer spending and economic growth,” Joanne Hsu, director of the survey, said in a statement.

Nearly one in five consumers surveyed said that unemployment will cause more hardship than inflation over the coming year. The government’s latest jobs report showed hiring was concentrated in only a few sectors, while the unemployment rate climbed to the highest level since the start of 2022.

The combination of higher inflation expectations and concerns about the durability of consumer spending highlight a difficult challenge for Federal Reserve policymakers as they debate further interest-rate hikes.

An index of buying conditions for durable goods slumped from a month earlier by the most since November of last year. A record 36% of consumers spontaneously blamed high borrowing costs or tight credit conditions for poor motor-vehicle purchase conditions. The share of consumers blaming similar factors for poor home and durable goods buying conditions was the highest since 1982.

“High price concerns for durables, vehicles, and homes declined steadily in 2022 following their mid-year peaks, but those improvements all stalled in 2023 as price worries remained highly salient for consumers,” Hsu said.

The current conditions gauge dropped to a six-month low of 65.7. A measure of expectations fell to 56.9, also the lowest since May.

--With assistance from Chris Middleton.

(Adds graphic)