A British insurance group is pushing its members, which include Allianz SE, Aviva Plc and Chubb Ltd., to step up their efforts to fight biodiversity loss as part of their broader climate-related goals.

In a guide published Tuesday, the Association of British Insurers said members should incorporate biodiversity impacts in their climate transition plans and net zero targets. They also should consider offering new policies, such as those covering damage to natural infrastructure.

The ABI said it’s hard to protect nature because it is location-specific, tricky to measure and sometimes undermined by competing interests. “Many businesses have not found it easy to assess their reliance on nature, or to recognize its importance to their business strategies,” said ABI’s Director General Hannah Gurga in a statement.

Insurers have grappled with other challenges on the climate front. In May, several large companies stepped away from the world’s biggest climate alliance for insurers after Republican attorneys general in the US accused the group of antitrust violations.

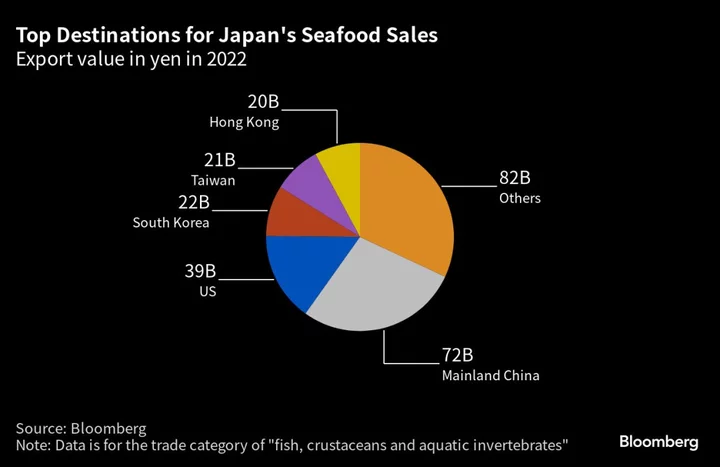

Biodiversity — including pollinating bees, marine life, rainforests and agricultural soil — is declining at an unprecedented rate as a result of exploitation, land-use change, pollution and extreme weather. The World Economic Forum estimates that roughly half of global GDP, or about $44 trillion of economic value, depends on the natural world in some way.

Insurers are being alerted to the loss of biodiversity because trees, soil and the oceans absorb carbon from the atmosphere, and are therefore crucial to the net zero goals set by companies and governments. Nature loss can weaken natural boundaries and increase the risk of flooding for insured homes and businesses.

Other actions insurers can take include scaling up investment in nature-positive businesses or projects, and underwriting or investing in sustainable or green bonds, according to the ABI.

ABI’s move follows similar private sector initiatives that coincided with a new global biodiversity framework that called for the mobilization of at least $200 billion per year by 2030. AXA Investment Managers, Columbia Threadneedle Investments, BNP Paribas Asset Management and eight other asset managers have previously launched a nature-protection campaign with a view to getting at least 100 firms to protect and restore ecosystems via investor-company engagements.

(Adds more context in seventh paragraph)