UK house prices fell for a sixth consecutive month in September but the slump in Britain’s property market is showing signs of easing, Halifax said.

The average price of a home declined 0.4% from August to £278,601 ($339,150), the mortgage lender said in a statement Friday. It left values 4.7% lower than a year earlier.

The figures contrast with rival mortgage lender Nationwide Building Society, whose own survey showed house prices remaining flat in September. However, the monthly fall reported by Halifax was much less than August’s 1.8% decline, and both lenders said recent dips in mortgage rates give reason to believe the housing market is heading for more stability.

Analysts expect house prices to fall around 10% from their peak in August last year. It means the property market may be halfway through the downturn.

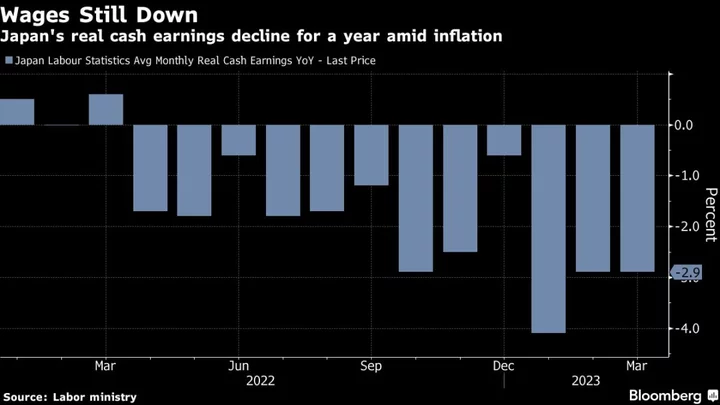

“With Base Rate now likely to be at or around its peak, we are seeing fixed rate mortgages deals ease back from recent highs,” said Kim Kinnaird, Halifax mortgages director. “Wage growth also remains strong, which has helped with affordability, with the house price to income ratio now at its lowest level since June 2020.”

The house price to income ratio is now 6.2 versus 6.3 in August, Halifax said, helped by rising wages and falling property prices.

While prices fell around £1,200 on the previous month, and are £14,000 below the August 2022 peak, they are still £39,400 higher than pre-pandemic and £2,700 above their level when the Bank of England’s base rate began to rise in December 2021.

Signs that the housing downturn is easing will help Prime Minister Rishi Sunak in the run-up to a general election expected late next year.

All UK nations and the nine English regions recorded sliding prices, with the biggest falls seen in the South of England where the average property has slipped 5.7% over the past year. Northern Ireland currently has the most resilient house prices.

While London’s residential property has edged down 4.8% over the past year, it is still the most expensive place in the UK to buy a home with the average price at £525,678.

Read more:

- UK Rents Surge at Record Pace as Home Sellers Lift Asking Prices

- Now Americans Are Buying Up Scotland’s Most Expensive Housing

- BOE’s Broadbent Sees ‘Clear Signs’ UK Economy Is Weakening