Britain’s biggest water supplier, Thames Water, is in talks with officials over contingency plans including a temporary nationalization as concerns grow over its more than £13 billion ($16.5 billion) debt pile, according to people familiar with the matter.

Talks are underway between water regulator Ofwat, the Department for Environment, Food and Rural Affairs and the Treasury about bringing the utility company into a so-called special administration regime, according to two of the people. One said they hoped nationalization would not be necessary.

The company’s debt took a hit, with one of its bonds falling 35 pence on the pound. Ministers are expecting to be called to the House of Commons later Wednesday to outline the plans, according to one of the people.

Thames Water provides water services for 15 million people in London and the South East. Its Chief Executive Officer Sarah Bentley stepped down with immediate effect on Tuesday amid concerns over the financial stability of the firm.

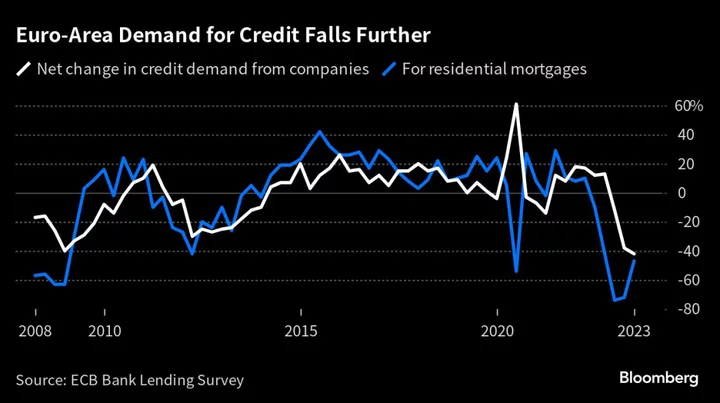

England’s privatized water companies have historically relied on the public debt markets to fund their operations. Environmental campaigners have accused them of borrowing heavily to fund large dividends and executive bonuses instead of investing more heavily into the system’s often-antiquated infrastructure.

Sewage Spills

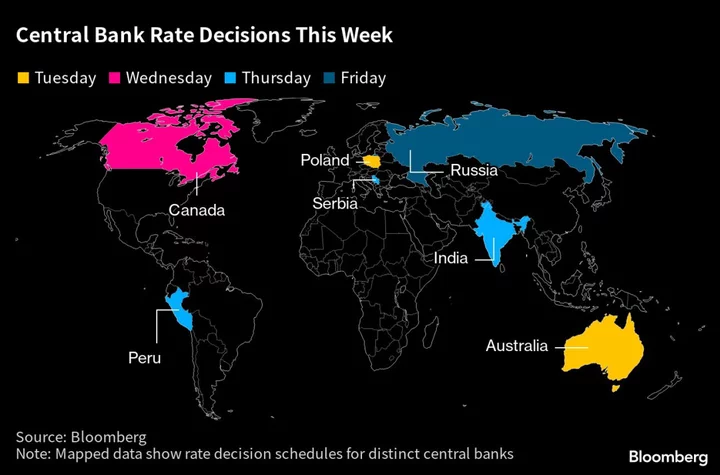

Rocketing interest rates are putting pressure on leveraged companies. At the end of March, Thames Water had the highest regulatory gearing in the sector at more than 80%, according to a note from Martin Young, an analyst at Investec.

Read More: Water Firms Will Turn to Debt Markets to Fix UK Sewage Crisis

The sector has faced public outrage over sewage spilling into rivers and along coastlines and is struggling to cope with the UK’s increasingly hot summers. The country suffered a long drought last year and utilities have imposed restrictions on families’ water use, despite a large number of leaks in Britain’s antiquated pipes.

Bills are likely to rise as water companies present plans to Ofwat to fix more infrastructure from 2025, Investec’s Young added in the note.

A government spokesperson said it would prepare for a range of scenarios, adding that the water sector as a whole was financially resilient.

Debt

Thames Water had £4.3 billion of secured bank loans and private placement notes at the end of September and £9.5 billion of bonds issued out of different units, out of which £2.8 billion are linked to UK inflation. Each of the units offer different security to investors.

Thames Water Kemble Finance notes fell the most, with the bonds due 2026 down 35 pence on the pound to 51 pence, according to data compiled by Bloomberg. Those notes are issued at holding company entity that depends on dividend payments from the operating company to pay down debt.

In May, Ofwat changed the rules linking dividends directly to operational performance on service delivery for customers and the environment, leaving Kemble Finance creditors potentially less covered, according to the ratings firm Fitch.

Notes of the Thames Water Utilities Finance unit due 2027 fell 3 cents on the euro to 96 cents, the data show.

Difficult Positions

Speaking to Sky News on Wednesday, children’s minister Claire Coutinho declined to comment directly on the plans.

“I certainly think there are water companies like Thames Water which are in difficult positions,” she said. “But I think our position as government is to make sure that we have the right policies in place to see consumers protected.”

Darren Jones, a Labour party Member of Parliament who chairs the House of Commons Business and Trade Committee, told the BBC that the government shouldn’t be nationalizing the whole water industry. However, he said “if we ended up in a situation where the private owners of these companies have completely messed it up, then there is no choice for the government other than to bring it into public ownership and to run it.”

A spokesperson for Thames Water did not immediately respond to a request for comment. Ofwat did not immediately respond to a request for comment.

AlixPartners has been undertaking operational improvement work on Thames Water for a couple of months, while Rothschild is also advising the company, according to people familiar with the matter.

A spokesperson for AlixPartners declined to comment.

--With assistance from Eamon Akil Farhat, Luca Casiraghi and Tasos Vossos.

(Adds detail throughout.)

Author: Kitty Donaldson, Priscila Azevedo Rocha, Dinesh Nair and Irene García Pérez