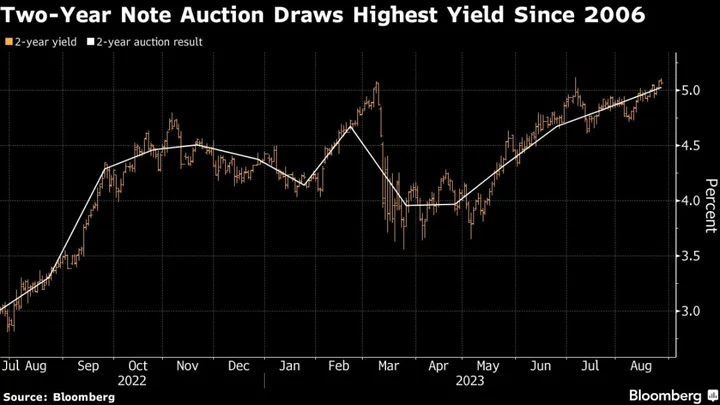

An auction of two-year Treasury notes Monday drew the highest yield since 2006, reflecting the US bond market selloff that deepened last week in anticipation of another Federal Reserve rate increase.

The $45 billion auction was awarded at 5.024%, eclipsing last month’s result as the highest-yielding since before the financial crisis. It will pay interest at a rate of 5%, also the highest since 2006.

While market yields for existing two-year notes remain slightly below the multiyear high reached during the first week of July, two-year note auctions fall late in the month, so the previous auction results didn’t capture that peak. Until this month, the highest two-year auction result in 2023 was 4.823% last month.

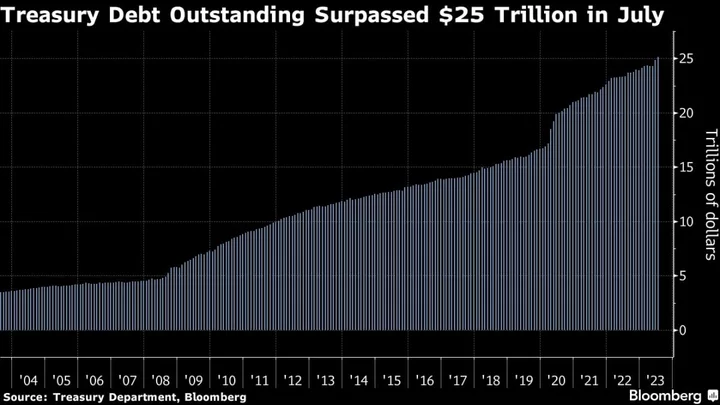

Two-year yields climbed nearly 14 basis points last week, including on Friday after Fed Chair Jerome Powell said the central bank is prepared to raise interest rates further if needed. Treasury yields also have been pushed higher by growth in the supply of new notes and bonds to finance the US government’s widening budget gap.