Turkey’s newly-installed central bank Governor Hafize Gaye Erkan will step into the spotlight for the first time on Thursday when she unveils fresh inflation forecasts, a fraught moment for an institution still struggling to regain credibility under her stewardship.

The setting for Erkan’s public debut is the presentation of a quarterly inflation report in Ankara, once a can’t-miss-event that’s been written off by economists and investors in recent years as her predecessor repeatedly took the stage to defend wildly optimistic projections.

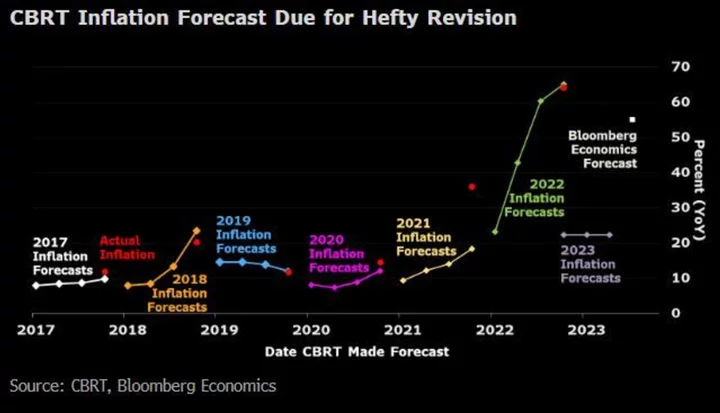

The intrigue is back this time, though little doubt remains that the central bank is set for a sharp uplift of its call for price growth it last predicted would end the year at 22.3%, or nearly 16 percentage points below the level in June.

Bloomberg Economics anticipates policymakers will nearly double their projection, a view that would still fall far short of its expectation that inflation will reach 55% by December. JPMorgan Chase & Co. last week revised its year-end outlook even higher to 57%.

“The inflation forecast trajectory that the central bank is expected to announce will be followed closely by the market,” Deutsche Bank AG analysts Yigit Onay and Christian Wietoska said in a report. “Disclosure of an unrealistic inflation path could pose risk of inflation expectations to remain unanchored due to a surge in inflation expected in the coming period.”

Erkan knows the stakes are high and time is short to regain market trust. Local assets have been under pressure since President Recep Tayyip Erdogan won a May runoff and revamped his economic team, with the lira losing about a quarter of its value against the dollar since the election.

Read more: Former First Republic Star Erkan Nabs Top Job Back in Turkey

The appointment of Erkan and Finance Minister Mehmet Simsek, with years of experience at US investment banks between them, held out the promise of an aggressive pivot from unconventional policies under Erdogan that contributed to an exodus of foreign investors and an inflation crisis last year.

But Erkan’s two interest-rate hikes by a cumulative 9 percentage points confounded the market, which expected an even sharper liftoff for borrowing costs that remain deeply negative when adjusted for prices. As part of an approach the central bank describes as “gradual,” it’s also turned to alternative tightening measures to curb loan growth and mop up excess liquidity.

What Bloomberg Economics Says...

“We expect inflation to reach 55% by December and see risks tilted to the upside. The central bank’s July rate hike has already undercut expectations. If its tightening cycle peaks at a lower rate than anticipated, that would cause both the lira’s depreciation and price gains to pick up pace.”

— Selva Bahar Baziki, economist. Click here to read more.

On Thursday, the limelight will fall squarely on Erkan, who’s barely spoken in public since her appointment in early June. A question-and-answer session usually follows the presentation of inflation reports.

Turkey’s first female central bank governor is a relative unknown in her home country despite a top-flight career in the US that included long stints at Goldman Sachs Group Inc. and First Republic Bank.

Besides the direction of monetary policy, Deutsche Bank also expects Erkan to face questions about her plans for managing an emergency savings program set up in 2021 to stabilize the lira.

The market will parse Erkan’s message for clues as Turkey faces a precarious outlook for inflation. A series of election pledges that included wage hikes will keep consumer prices under pressure as the government gears up for local elections next year that could again make economic growth a priority.

Erkan is walking a fine line after what Erik Meyersson, chief emerging-market strategist at SEB AB, said looked like “a stretched attempt to gain market credibility without backing it up with sufficient action.”

Meyersson said the central bank’s new projections will “more likely fall well below credible forecasts, which will be internally consistent but limit the credibility of the economic policy team, possibly opening up for more financial volatility.”

(Updates with chart.)