The rush for intitial public offerings in Turkey shows no signs of abating, with nearly 100 companies awaiting approval to list next year.

The expected surge will follow a bumper year, with about 50 companies expected to debut on Borsa Istanbul by end-2023, Ibrahim Omer Gonul, head of Turkey’s Capital Markets Board, said in an interview with Bloomberg.

However, Gonul warned it was important to manage the pace of IPO approvals to ensure the market can absorb the new shares. He does not anticipate 100 IPOs will materialize next year, and instead sees about 50 listings being approved annually in the foreseeable future.

“Completing IPOs too fast may not necessarily be a good idea. It’s important to look at the state of the market, the conjuncture, whether there will be enough demand to complete the listings,” he said.

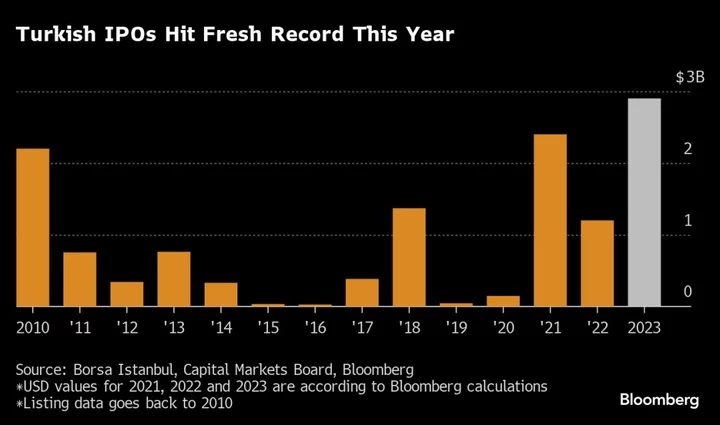

Turkey’s IPO boom has made it one of the largest listing venues in Europe, the Middle East and Africa this year, with 49 companies completing the listing process so far this year to raise a total of about 66 billion liras, or $2.9 billion, based on the average exchange rate this year. That surpasses all previous years, in US dollar terms as well as in local currency, in records going back to 2010 on the Turkish Capital Markets Board’s website.

The surge is partly driven by the country’s stock market boom, as inflation of around 60% lures ordinary citizens to equity investing in order to offset the erosion in the value of their savings.

Investing in newly listed shares has been especially popular — more than 75% of the stocks that made their debut in 2023 soared about 60% in their first five trading days. While Turkey’s main equity market is up 45% year-to-date, the Borsa Istanbul IPO Index, a gauge of companies listed in the past two years, has gained 98%.

Since 2020, when local mom-and-pop investors started to stream into the equity market, the IPO index has risen more than 4,400%. Data from the Central Securities Depository of Turkey shows the number of equity investors stood at 8.2 million as of Nov. 19, nearly triple year-ago levels of 3.3 million.

Turkish Investors Hunting for Inflation Hedge Rush Back to IPOs

Gonul called for caution however, advising punters to seek professional investment advice.

“Rising demand for equities is important, but we don’t want these investors to enter the stock market as if they’re playing games,” Gonul said. “A lot of investors are only targeting IPO stocks thinking they will always have supersized returns, but continued gains can never be guaranteed.”

He noted there had been a rise in complaints to regulators from new investors whose stock holdings had lost value, with many demanding guarantees from the government to make up the losses.

“If you’re looking for a state-guaranteed investment product, then you should go and buy bonds,” Gonul added.

Turkish Stocks Have Biggest Monthly Drop Since March 2020

Domestic investors’ strategy of buying equities as an inflation hedge is coming under pressure, however, as Turkey’s central bank tightens monetary policy. The weighted average interest rate on lira deposits with a maturity of up to three months has climbed to a new 20-year high of 45.85%. Those higher rates could appeal to investors seeking to protect their equity market profits.

“Should there be outflows from the bourse due to a rise in deposit rates, that may also lead to a slowdown in the new listings,” Gonul said, though he added he does not expect this to happen.