Yellow Corp. filed for bankruptcy after the trucking firm’s long-running financial woes were compounded by a dispute with its labor force.

The carrier listed assets of $1 billion to $10 billion, and liabilities in the same range, in a Chapter 11 petition filed in Delaware. The filing gives Yellow breathing room from creditors while it sorts out a way to repay them.

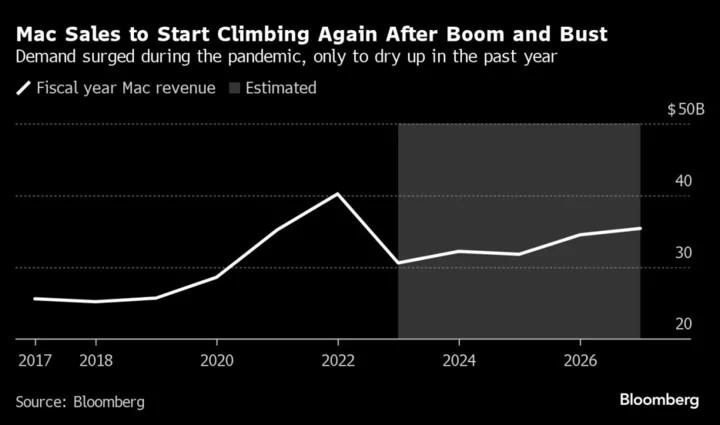

The Nashville-based company earlier notified union officials that it planned to file for bankruptcy after ceasing operations, according to a statement from the International Brotherhood of Teamsters. Trucking firms and other companies across the shipping industry have been burdened by a slowdown in freight demand coming out of the pandemic.

Read More: Trucking Firm Yellow Mulls Asset Sale Through Bankruptcy Filing

Yellow is the third-largest less-than-truckload carrier, meaning it accepts shipments that don’t fill a whole trailer. The company has been struggling financially as it stares down more than $1 billion of debt that matures in 2024. It has also traded barbs with the International Brotherhood of Teamsters, blaming the union for gumming up plans to reshape its trucking divisions.

Bankruptcies tend to bite less-than-truckload carriers hard because shippers often divert their loads to competitors, weakening already-struggling companies in a manner similar to bank runs, Bloomberg Intelligence’s Lee Klaskow said in a July 27 note.

The US Treasury gave Yellow a $700 million pandemic-relief loan in 2020 that has since come under scrutiny. The debt made up 95% of what was dispersed under a Cares Act program to offset losses for businesses critical to national security, but Congressional investigators last year concluded the company was ineligible for the loan.

Yellow has faced years of financial stress. The company staved off a bankruptcy filing in 2009 after bondholders agreed to swap debt for equity, only to have to restructure again in 2011.