Canadian companies are painting a stark picture of a consumer who’s pulling back on spending, as rising debt payments and inflation force households to change their behavior.

From big-box retailers to toy marketers to coat manufacturers, recent corporate earnings results and executives’ comments underscore how quickly the economic temperature is changing after two years of robust growth.

Canadians have the highest household debt levels among Group of Seven countries, and they feel the pinch of higher rates sooner than US consumers because their mortgage terms tend to be shorter. More than a third of mortgage borrowers have seen their payments increase since February 2022, according to central bank data.

Consumer weakness spilled into full view in Canadian Tire Corp.’s third quarter as its customers curbed spending on non-essential items, pushing comparable sales down 1.6% relative to the previous year. The company — which owns a collection of retail brands that sell sporting goods, hardware, auto parts, clothing and other categories — said the soft trends were particularly notable in Ontario and British Columbia, the two provinces with the most expensive housing markets.

Chief Executive Officer Greg Hicks calls it an environment of “relentless uncertainty,” despite economists’ belief that rate hikes are likely done.

“The future is increasingly murky, given the Bank of Canada’s pause was couched in a hawkish tone around risks of further inflation and the potential of more policy rate moves down the road,” Hicks told analysts.

Spin Master Corp., a Toronto-based toymaker that sells brands such as Paw Patrol and Bakugan, reported a 29% decline in gross sales of toy products in Canada in the first nine months of the year, compared with a 20% drop in the US. CEO Max Rangel said toy orders have slowed, “particularly from mid-October. We expect this trend to persist for the remainder of 2023.”

Canada Goose Holdings Inc., the maker of parkas and other high-end clothing, also reported small declines in Canadian and US sales in its most recent quarter. It’s the worst performing stock in the S&P/TSX Composite Consumer Discretionary index over the past three months.

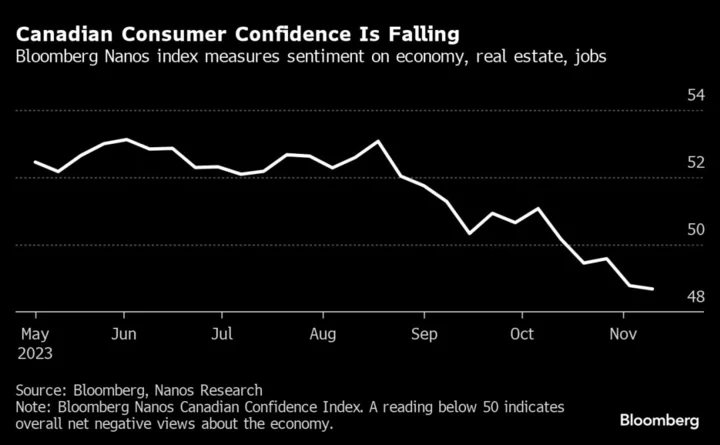

One challenge for policymakers in North America is that people are bracing for more inflation in the future, eroding confidence. US consumers’ long-term inflation expectations increased to the highest since 2011, according to a new reading from the University of Michigan. In Canada, while inflation expectations have eased, they’re still well above the Bank of Canada’s own inflation forecast, which sees inflation returning to around 2% in the latter part of 2025.

That also implies rates may stay elevated for longer — which would mean future financial pain for millions of Canadians with mortgages where the rates have yet to reset.

Transportation companies are among the first to feel the shift in consumer sentiment. Cargojet Inc., an air-cargo shipper that boomed during the pandemic with the rise in online shopping, saw revenue decline 8% from year-earlier levels in the third quarter.

CEO Ajay Virmani echoed Canadian Tire’s view of consumer patterns. “We are observing a division in household spending,” he said. “The volumes for discretionary items are softening but the volumes for essential household goods are holding up well.”

Investors in US consumer companies are also heading into a critical period, with bellwether names like Walmart Inc., Target Corp., Home Depot Inc. and Macy’s Inc. all scheduled to report earnings this week.