Japan’s government-backed Rapidus Corp. is lobbying chipmakers, their suppliers and research institutions to set up shop on the island of Hokkaido in a bid to make the remote region a center of semiconductor innovation within a decade.

The 13-month-old startup’s goal to make cutting-edge chips from scratch is part of a broader design to build a Silicon Valley-like ecosystem. Rapidus envisions a chipmaking cluster spanning coast to coast, with easy access to multiple ports, according to Chief Executive Officer Atsuyoshi Koike.

“My big ambition is to realize a ‘Hokkaido Valley’ that spreads from Tomakomai to Ishikari that can compete against Silicon Valley in size,” Koike, 71, a former Western Digital Corp. executive, told Bloomberg News. “We have a chance to become a North Star” that sets the trend in the global chip industry, he said.

Rapidus, a company backed with billions of dollars in taxpayer funds and support from household names like Sony Group Corp. and Toyota Motor Corp., is plotting a course to mass-produce 2-nanometer logic chips by 2027. If successful, the long-shot endeavor would mean a generational leap in tech for Japan, whose chip making capability stalled decades ago at now-legacy 40nm nodes.

Koike is inviting manufacturers throughout the supply chain to invest in Japan’s northernmost prefecture of Hokkaido, where Rapidus is building a factory in preparation for pilot line operations in 2025. Companies need to work together more effectively toward a common goal, the chip veteran said. Working separately “is not the right way,” he said.

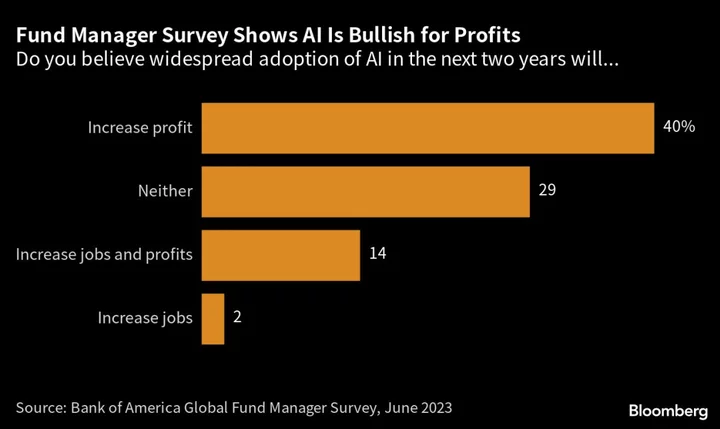

Instead of competing against global chip giants that make large volumes of all-purpose chips, the Tokyo-based company will focus on pioneering specialized chips, such as low-power-consumption AI chips, Koike said. Hokkaido, which has ample clean water and is one of Japan’s top producers of renewable energy, is an ideal location to stage a chip renaissance, he said.

The venture is central for Prime Minister Fumio Kishida’s signature project to revive Japan’s status as a chip superpower and jump-start the long-stagnant economy. The ability to domestically make the most advanced chips is crucial to lowering dependence on sector leaders Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. in an era of artificial intelligence and rising US-China tensions, policymakers say.

Japan has allocated $2.4 billion for the venture, with officials saying they’re prepared to provide a comparable budget every year. Kishida has pledged “utmost support” to Rapidus to keep the venture on track.

Daunting hurdles remain, however. A shortage of engineers is constricting chip production around the world. Rapidus employs just 200 people, compared with more than 73,000 at TSMC, which is also hiring workers for its new factory in Japan’s southwestern prefecture of Kumamoto.

Still, Koike says he’s confident. California-based Lam Research Corp. and Belgium-based microelectronics research hub IMEC aren’t the only ones setting up shop in Hokkaido, he said. Many Japanese chip material suppliers and equipment makers are also considering production sites close to Rapidus’ upcoming plant, he said.

TSMC’s success in spurring economic growth in Kumamoto Prefecture is generating high hopes about Rapidus’ impact on Hokkaido.

Known for its ski resorts and agricultural produce, Hokkaido has been wooing manufacturers for years, touting its track record of fewer quakes compared with the rest of Japan as well as its access to water and renewable energy sources. Hokkaido has little heavy manufacturing following the shuttering of its last coal mine in 2002. The prefecture earns about 4% of Japan’s gross domestic product.

Creating Hokkaido’s version of Silicon Valley will take time, but is feasible, Koike said. “We’d like to get there by around 2030.”

Author: Matthew Winkler, Takashi Mochizuki and Yuki Furukawa