The third quarter was a story of dashed hopes in emerging markets, with the unraveling of some of the most profitable trades in the asset class.

A stronger dollar and surging US yields, combined with China’s economic woes, brought it all to a head. Emerging-market stocks just posted their worst quarter in a year, wiping out the majority of 2023’s gains. Currencies aren’t far behind.

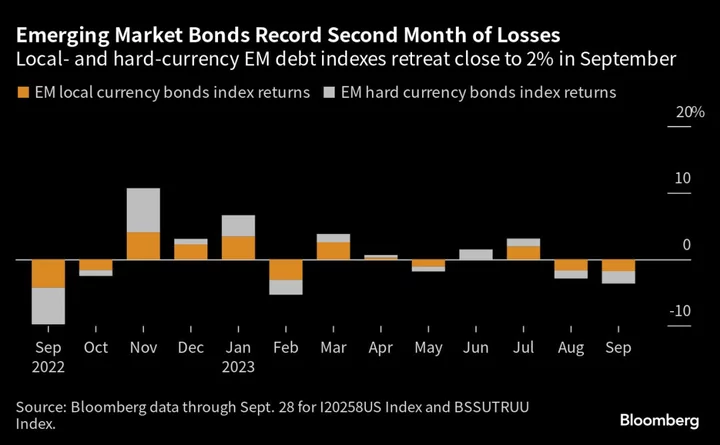

Investors have also fled bonds, with both local- and hard-currency fixed income indexes sliding in the third quarter, according to data compiled by Bloomberg.

“Emerging markets have been plagued by twin challenges, China and Fed policy,” said Todd Schubert, Dubai-based senior fixed-income strategist at Bank of Singapore. “China constitutes roughly one-third of the emerging-market corporate universe, so its underperformance has been a huge drag on the asset class as a whole.”

Read more: Developing-World Stocks Erase 2023 Gains on Rate Angst

Recent losses have come alongside a surge in global volatility, fueled by renewed concern over China’s property crisis and a rise in US Treasury yields. An emerging-market implied volatility index rose as much as 3.33 percentage points over the past week, the most in a year, the data show.

Getting Worse

The news out of China has combined recently with renewed pessimism over the outlook for US interest rates. That has sent currencies tumbling in countries that had started to cut borrowing costs, such as Chile and Hungary.

“It was already a pretty painful eight, nine months,” said Sergey Goncharov, a money manager at Vontobel Asset Management. “But, really, the confirmation by the Fed and further appreciation by the market that rates will probably stay for long is really causing some volatility. The past few days have been specifically painful.”

The recent declines are all the tougher to take in light of the bullish calls made earlier in the year by Wall Street money managers.

Goldman Sachs Group Inc. and Pacific Investment Management Co. were some of the last big names to announce bullish views on emerging markets in February, with Pimco saying the category appeared positioned for stronger performance in 2023. At the time, foreign-currency debt from the developing world was having its best start since 2019 and almost all currencies were up against the US dollar.

Read more: Pimco Sticks to Bullish Stance on Emerging Markets Amid Selloff

Pimco is standing by its bullish stance, saying there is a “disconnect” now between what the market is pricing in regarding recession probabilities and the asset manager’s view.

Looking Ahead

About $688 billion in shareholder wealth in emerging-market stocks has been erased in September, bringing the total wiped out since July 31 to $1.54 trillion, according to an analysis of data compiled by Bloomberg.

The cash flow that was meant for emerging markets likely stayed in US large cap stocks, according to Sylvia Jablonski, co-founder and chief investment officer at Defiance ETFs. Even with uncertainties around US rates, investors feel safer holding large cap stocks that have generally performed better this year, held up earnings and have decent growth outlooks.

“On the bright side, emerging market stocks are at an attractive entry point for those with patience, to buy and hold,” Jablonski said. “Global leaders are ending their hawkish campaigns, or at least those endings are in sight. It is reasonable to believe that emerging markets as it is priced today, will be higher a year from now. It will take time for the trade to play out.”

But with the whole asset class unlikely to bounce back as one, investors will have to be picky to ensure profits.

Some are eyeing currency relative value trades as pockets of opportunity. These kinds of trades take the US dollar out of the equation, and focus more on crosses where one currency is expected to outperform relative to another regional counterpart.

“Relative-value opportunities may present themselves, mainly in Asia and EMEA where currencies have already adjusted to some extent,” Olga Yangol, Credit Agricole CIB’s head of emerging-market research and strategy for the Americas.

Read more: Goldman, HSBC Grow Cautious on One of Year’s Hottest EM Trades

Goldman Sachs’ Caesar Maasry also favors relative-value trades, betting on Korean equities versus Australia’s, and EM stocks ex-China versus Europe’s. He also likes the Middle East because of the oil rally. Within currencies, he likes the Brazilian real and the Colombian peso versus the Chinese yuan.

Even with elections looming in Argentina, Poland and Egypt in the fourth quarter, potentially boosting volatility, there may be some price recovery for emerging market assets.

“Around the turn of the year we should see clearer evidence that the US economy is slowing, while China’s economy starts to revive,” said Julio Callegari, CIO of Asia fixed income at JPMorgan Asset Management. “In that scenario, we see room for a recovery in emerging market assets.”

What to Watch

- The National Bank of Poland may resist cutting its reference rate in October after delivering a jumbo 75-basis-point cut in September

- Turkish inflation is set to pick up pace for the remainder of the year, with additional challenges posed by the weak lira and rising oil prices

- In Sri Lanka, the central bank may cut rates further to keep up with a plunge in inflation that’s sent real borrowing costs upward

- The Reserve Bank of India is expected to maintain a hawkish hold, with upside risks to inflation receding

--With assistance from Srinivasan Sivabalan, Netty Ismail, Zijia Song, Karl Lester M. Yap and Vinícius Andrade.