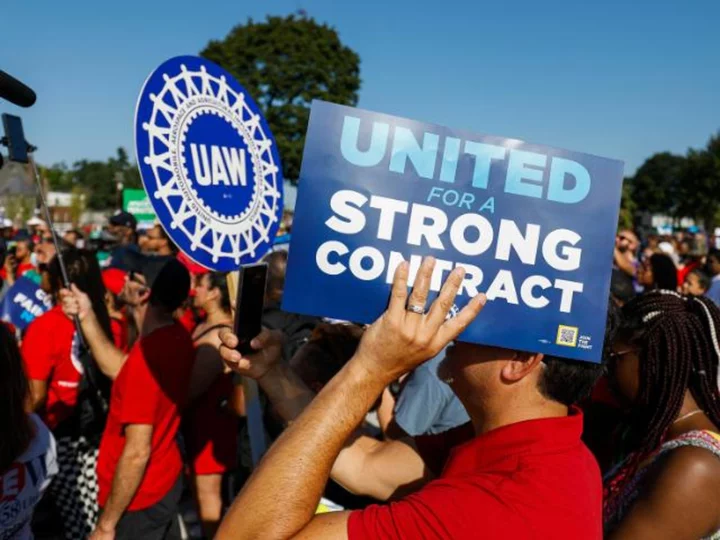

Time is running short to avoid a strike at America's three unionized automakers, and the distance between the United Auto Workers union and the companies remains large.

The contracts with the three automakers all run out at 11:59 pm Thursday, and UAW President Shawn Fain insists the union stands ready to go strike on Friday at any company that has not reached a tentative deal by then.

He admits the union's demands are "ambitious" but he insists they're justified given the automakers' strong profits in recent years. The automakers have balked at most of the union's demands, according to the UAW.

Here is what the union is demanding ... and what happens next.

Raises

The union demands an immediate 20% raise, and then four additional raises of 5% each. Taken together they would would increase hourly pay by 46% over the four-year life of the contract.

The UAW said Friday that GM and Ford are each proposing 10% increases in the hourly wage rate over the next four years in their most recent offers, while Stellantis, which makes cars in the US market under the Jeep, Ram, Dodge and Chrysler brands, is offering 14.5% raises. In comments to members Friday, Fain called those offers "insulting," given the automakers' sizable increases in profits in recent years.

Despite the large gap, the union can still score big wins in wage gains, particularly by eliminating a lower tier of wages for workers hired since 2007, said Art Wheaton, director of labor studies at Cornell University's school of Industrial and Labor Relations in Buffalo. He said he thinks there will eventually be a deal that the union leadership can accurately describe as a win for members, even if it falls short of its current demands.

In the union's favor is the current strong demand for cars and trucks, and near-record prices for new vehicles. That produced record profit for GM last year, and near-record profit for Ford. Stellantis profits were also up, but that company was only recently formed by a merger (in early 2021).

It's always better for unions to be negotiating with financially healthy companies rather than struggling companies.

"The difference between the automakers and the unions on wages is a gap that could be closed," said Patrick Anderson, CEO of Anderson Economic Group, a Michigan research firm.

Pensions and inflation adjustments

It could be more difficult to reach a deal on the union's other issues.

"The differences involving non-wage demands are a gulf, not a gap," said Anderson.

The UAW wants a return of traditional pension payment plans and retiree health care for all UAW members. Workers hired before 2007 still have those benefits. Those hired since -- a majority of hourly workers -- do not.

The union also wants automakers a return of cost-of-living adjustments (COLA) to protect members from inflation.

The autoworkers union gave up the pension plans and retiree health care for new hires and COLA for all members in 2007 when GM and Chrysler were hurtling toward bankruptcy and federal bailouts. It will be difficult for the union to convince management to agree to give them to members once again, no matter how profitable the automakers have become, Anderson said.

"These raise the risk of a contract that causes bankruptcy-level risk for the automakers when a future downturn occurs," Anderson said. "COLAs and defined benefit pensions represent future costs that cannot be known, in an industry that has always been cyclical and which now has additional vulnerabilities related to an uncertain transition to electric cars."

Wheaton similarly believes the union will ultimately lose its battle for the return of pensions.

"I think the chances of them of winning even most of what they're looking for is between slim and none," said Wheaton. For example he said, "I wouldn't hold my breath for [return of pension plans]. Almost no one in any industry is adding those today."

"But you never ask for the minimum, you ask for more than what you want to reach a deal," he said.

Job protections and benefits

The union demands limits on the use of temporary workers and forced overtime. The union also wants more time off for workers, including a four-day workweek. And the UAW is fighting to gain certain job protections for workers, including the right to strike over plant closings.

Cornell's Wheaton believes the union could ultimately win limits on the use of lower-paid temporary workers.

But that won't make up for all the union's job losses over recent decades. Its membership has plunged since its heyday more than 50 years ago, caused by a combination of automation, outsourcing and the loss of market share in their home market by the Big Three automakers. By the union's counts, 65 US auto plants have closed this century, the most recent a Stellantis factory in Belvidere, Illinois, earlier this year.

There were 152,000 members at GM alone in 1998 when the UAW struck that automaker, more than the membership on the job at the three automakers today. Today there are 46,000 at GM, 57,000 at Ford and about 42,000 at Stellantis.

A 'just' transition to EVs

Making a deal even more difficult, the negotiations come in the midst of the biggest change the auto industry has experienced in nearly a century: the transition to electric vehicles, or EVs.

The three automakers have all announced plans to spend tens of billions of dollars on EVs, even though none of the legacy automakers' EVs make up more than a sliver of their current sales. The automakers expect growing demand for EVs, and they must comply with tougher environmental regulations.

But they also see it as a path to be more profitable, because an EV has far fewer moving parts than a gasoline powered car with its complex engines and transmission. EVs require about 30% less labor to assemble than a gasoline powered car, according to industry estimates.

That's a major concern for the UAW. Fain and other union leaders say they're not opposed to EVs but that it must be a "just transition." As members lose their jobs building gasoline engines and transmissions, they should be able to shift to jobs building EV batteries and other parts, the union demands, says the union. And they say those jobs should pay the same scale that UAW-represented jobs at auto plants pay.

But at a GM joint-venture plant in Ohio, battery workers get far less than the current pay at the UAW auto plants, even after they were granted 20% raises in a recent contract negotiation. The Big Three have plans for nine more joint-venture battery plants between them. All are expected to pay far less than current UAW scale at the auto plants, and far less than members would receive after they win a raise in this contract.

The wages for the workers at these joint ventures is not a subject of these negotiations. But the protections for existing workers whose jobs could be at risk from the transition will be a key issue.

What's next

Talks will take place throughout this week. The union could still make substantial gains in its contract negotiations, and deals may still be reached by the Thursday night deadline, even if the two sides are far apart today. Both union leadership and the companies all say they want to reach deals that will avoid strikes.

A strike would be costly to the automakers. GM put the cost of the six-week strike by the UAW in 2019 at $2.9 billion.

And it would be costly to the economy. Anderson Economic Group estimates that a strike against all three companies would be a $5 billion hit to the economy after just 10 days.

If a strike against all three automakers occurs, it will be unprecedented, according to Gavin Strassel, the UAW archivist at the Walter Reuther Library at Wayne State University in Detroit. Typically the union has picked one company as the focus of negotiations, naming it as its so-called "target." And even if it struck that target, it would typically remain on the job at the other two automakers during that strike.

But Fain has insisted the union will not use that playbook this year, that it is prepared to go on strike against all three if no deals are reached by Thursday night.

If it does so, it would be the nation's largest strike by active employees in 25 years. While there are more than 170,000 actors and writers currently on strike against Hollywood studios and streaming services, most of those union members were not actively working on movies or shows at the time those strikes started earlier this year.