China’s economy is showing clear signs of a slowdown that will have an inevitable spillover to the region, according to Taiwan’s top emissary to the US.

“There are some alarming indications and we are impacted,” Hsiao Bi-Khim told Bloomberg News, citing a drop in Taiwan’s exports to China. “Despite all the political and strategic tension, we are interested in prosperity for the people on both sides of the strait.”

The slowdown has sharpened Taiwan’s focus on reducing its vulnerability to the world’s No. 2 economy, with businesses actively considering ways to diversify their operations, Hsiao said in an interview at Bloomberg’s Washington bureau.

“Given the risk of over-dependence on any economy, friendly or not, it is important to ensure that we are less vulnerable,” she said on Friday. “We have been working to diversify our global assets and global presence.”

Fraying relations

President Joe Biden last month called China a “ticking time bomb,” citing a number of economic problems the Communist Party is facing. “That’s not good because when bad folks have problems, they do bad things,” he said.

Still, Biden on Sunday said China’s recent downturn may diminish any inclination by Beijing to invade Taiwan, adding that the country’s economic troubles have left his Chinese counterpart with “his hands full.”

Read more: Biden Doubts China Able to Invade Taiwan Amid Economic Woes

Asked whether she is worried a slowing economy could push Chinese President Xi Jinping to move on Taiwan, either militarily or through an economic blockade, Hsiao said leaders in Taipei are carefully considering all possible scenarios, including the “worst case scenario.” China claims sovereignty over the island.

Still, “any signs of coercion or military aggression is not good for business,” she said. “That’s our understanding. We certainly hope that that is also the understanding of the leaders in Beijing.”

China is Taiwan’s largest trading partner, accounting for 25.2% of total trade and 21.6% of Taiwan’s imports in 2021, according to the Commerce Department’s International Trade Administration. The US comes in second, accounting for 12.6% of Taiwan’s total trade and 10.2% of imports.

Chip exporter

Taiwanese companies will consider market calculations more than political ones, Hsiao said. “Companies are thinking about how to position assets in a way that best protects their company interests,” she said.

Read more: Taiwan Determined to Remain ‘Indispensable’ Source of Best Chips

Taiwan is home to the world’s leading chipmakers and has faced a prolonged dip in demand for its technological goods — including its key product, semiconductors.

However, a year-long slump in Taiwan’s exports eased in August as rising global demand for artificial intelligence-related technologies hinted at a more positive outlook.

China’s slump

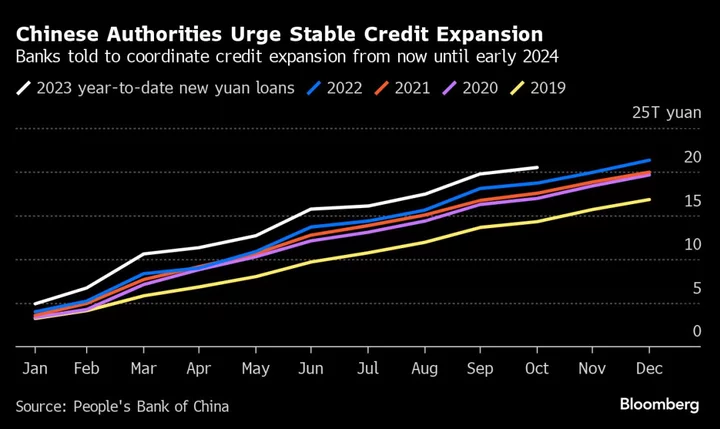

China has fallen short of expectations for a stronger recovery post-covid. A real estate slump and trade downturn have prompted Wall Street analysts to downgrade their growth forecasts, though they still match an official government target of around 5% for the year.

The government in Beijing has in recent weeks rolled out a slew of incremental measures to revive business confidence and help the property market, though they have so far avoided any large-scale fiscal stimulus amid concerns over the high debt-levels in the economy.

--With assistance from Eric Martin.