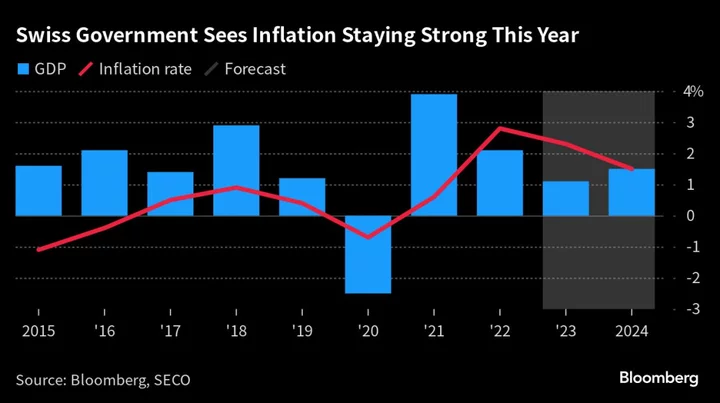

Switzerland’s government expects inflation to be above the central bank’s target this year — a forecast which reinforces a likely interest-rate hike next week.

The State Secretariat for Economic Affairs said consumer prices will rise 2.3% this year. That down from 2022’s 2.8%, and also slightly lower than a March prediction of 2.4%. SECO, which draws up economic projections for the government, maintained its 1.5% estimate for 2024.

It stuck with calls for economic output, predicting growth of 1.1% this year and 1.5% in 2024.

“The Swiss economy started the year vigorously, and energy prices continue to fall,” SECO said in a statement. “However, inflationary pressures remain high internationally and there are pronounced economic risks.”

Switzerland has the lowest inflation rate of any advanced economy. Still, Swiss National Bank President Thomas Jordan recently warned that price pressures prove more sticky than expected and therefore the fight “is not over yet.”

The central bank meets for its next interest-rate decision in a week and is widely expected to raise borrowing costs by 25 basis points, with some economists even betting on a half-point move.

Published concurrently, the KOF summer forecast of ETH Zurich’s economics center highlighted that thanks to the recent rise in the reference interest rate for rents, “dues for many existing rental contracts will be sensitively increased next fall.”

In its forecast, KOF assumes that around half of inflation in 2024 will be caused by rent increases. It expects price growth of 2.2% for this year and 1.5% in 2024.

Swiss growth came in unexpectedly strong at 0.5% in the first quarter. But forward-looking indicators including an index of purchasing managers have been pointing toward a slowdown amid subdued industry sentiment.

(Updates with KOF forecast from seventh paragraph)