The Swiss National Bank’s vice president said the central bank lacked the means to save Credit Suisse from collapse in March.

In an interview with SonntagsBlick, Martin Schlegel said the severity of the lender’s liquidity problems caught the central bank and regulators off guard, and that the SNB couldn’t have rescued the troubled lender by providing more liquidity and positive messaging.

Credit Suisse’s “liquidity flowed out much faster than the regulators in Switzerland and abroad had expected,” Schlegel told the newspaper, stressing that the SNB had “no mandate” to save or take over the troubled lender.

Panicked investors pulled their money from the bank as the crisis mounted, and Credit Suisse didn’t have enough ready collateral to access sufficient funds from the Swiss central bank. The SNB in March introduced a special uncollateralized facility to bridge the bank until its rescue by UBS Group AG could be brokered.

Schlegel said Credit Suisse’s so-called AT1 bonds, canceled as part of Credit Suisse’s takeover by UBS, should have suspended interest payments at an earlier stage.

“This would have meant immediate financial relief for the bank,” Schlegel said.

Schlegel pushed back against critics who’ve said the central bank should have provided more liquidity to Credit Suisse as well as offering public messages of support.

“A trust and profitability problem cannot be solved by a statement from the authorities,” he said. “People would see through that.”

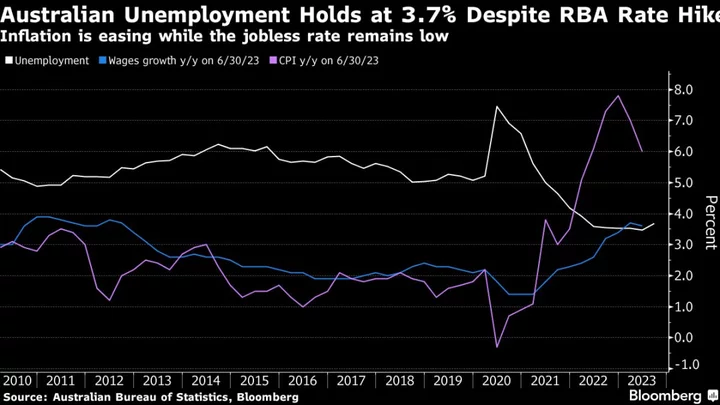

Asked about interest rates, the number two at the SNB behind President Thomas Jordan echoed comments made by his boss in September when the central bank took a surprise pause on raising its benchmark rate. He said that further increases may be needed.

“Overall, the labor market is still in very good shape,” Schlegel said. “Unemployment is still low. It cannot be ruled out that further tightening of monetary policy may be necessary. This depends on the development of inflation.”