Sweden’s embattled landlords are facing intensifying pressure to sell properties to raise cash, as $17 billion in debt matures over the next 18 months.

While real estate companies have resisted forced sales, time to act is narrowing. With bond and equity markets all but closed, disposals are becoming one of the last remaining options.

A disorderly rush to raise cash risks leading to hefty discounts in one of the world’s hardest-hit property markets. That could trigger a chain reaction that resets valuations across the industry and intensifies funding gaps. Sweden’s central bank has warned that landlords selling large volumes quickly could threaten the country’s financial stability.

“The number one option would be to recapitalize and ride out the storm, but that’s not available for everyone,” said Jonne Sandstrom, a portfolio manager at Aktia Bank. “I would be most worried if the general sentiment in the market deteriorates, whereby refinancing would become even more tricky.”

After record deal-making just over a year ago, commercial property transactions in Sweden have fallen to the lowest level in a decade. It’s a sign of the difference between the price sellers want and what buyers are willing to pay. A glut of credit downgrades — including a growing number of landlords dropping into junk status — suggest the standoff might soon end.

Why a Crisis Is Looming in Commercial Real Estate: QuickTake

“The higher interest rates are eating away the profit for smaller property firms with a lot of debt,” Sven-Olof Johansson, chief executive officer of FastPartner AB, said in an interview. “It will get harder to refinance bonds in the banking system, so this fall will be tough for them.”

FastPartner — one of the largest office landlords in Stockholm — lost its investment-grade rating earlier this month.

Troubled landlord Samhallsbyggnadsbolaget i Norden AB — better known as SBB — has been the epicenter of Sweden’s commercial real estate woes, but the problems go deeper. Four companies have bonds approaching yields that are at least 10 percentage points higher than Riksbank notes, putting them in distressed territory.

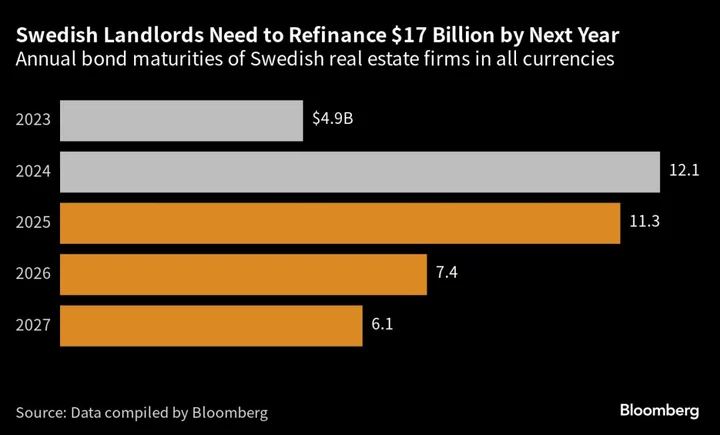

This year, debt maturities are relatively manageable at $4.9 billion, but the hurdle more than doubles to $12.1 billion in 2024. Heimstaden Bostad — a subsidiary of Heimstaden AB — has the largest amount due at $2.5 billion, while SBB has $765 million, according to data compiled by Bloomberg.

Read More: Swedish Landlord Heimstaden Asks Tenants to Pay for Rising Rates

The state of the sector will become clearer when first-half earnings reports start trickling out beginning on Tuesday with FastPartner. SBB presents its accounts on July 14.

So far downward adjustments to portfolios have been modest — not more than around 4% in the first quarter. That’s largely due to the dearth of transactions, and the first major deals in months will go a long way to determine how deep the rout becomes.

“The greatest risk of credit quality erosion is in Sweden, where companies face a wall of maturities in the next couple of years,” analysts at Moody’s Corp. said in a report on the real estate industry last month. The ratings company cited bonds with maturities of three to four years — about half the duration of other European property owners — putting the country at the forefront of the impacts of higher interest rates.

In January, Fastighets AB Balder became the first Swedish landlord to get a junk rating. Since then it has been joined by FastPartner and SBB. While bond yields for these companies are already trading at high-yield levels — and in SBB’s case significantly wider — the loss of investment-grade status means a narrower pool of bond buyers and much higher financing costs.

Shares in real estate firms have fallen more than 60% since the peak in late 2021, making rights issues a less favorable option. Furthermore, banks are getting more wary of increasing their exposure to the sector, which has sapped funding for deals.

“The banks have a big role to play in keeping the transaction market active,” Max Barclay, deputy chief executive officer and head of advisory at real estate service company Newsec, said in an interview. “But right now that is not working.”

Some investors have raised cash to take advantage of the situation, but they want discounts that property owners aren’t willing to grant. Moody’s base case is that by the end of next year, European commercial real estate valuations decline in a range of 5% to 15% from 2022 levels. Sweden’s could drop more in a “downside scenario.”

Landlords aren’t budging for now though, saying there’s no reason to undercut book values with occupancy rates high and cash flow stable.

Even SBB, which needs to roll over $1.6 billion of maturing bonds within the next three years, says it won’t offer discounts for its properties, according to new CEO Leiv Synnes. The company last week sold properties in the southern town of Linkoping to an entity owned by the municipality, but the proceeds of $37 million are just a small dent in its overall financing needs.

“There’s no reason for us to sell any assets in this market,” said FastPartner’s Johansson. “Now it’s not the time to sell — it’s when rates are low.”

--With assistance from Libby Cherry and Steven Arons.