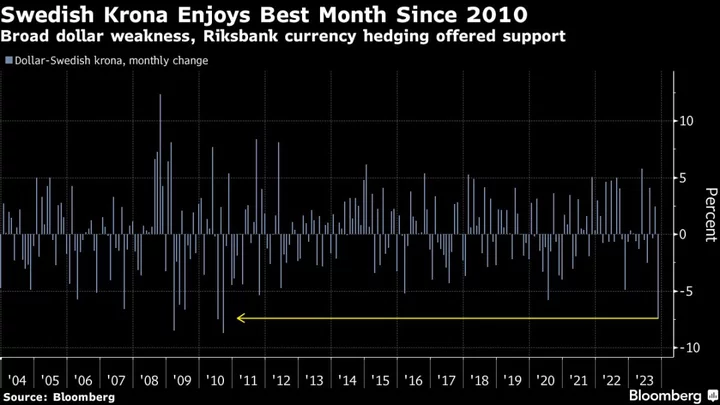

The Swedish krona posted its best month in more than a decade, as improving risk appetite and the central bank’s pledge to stay open to more rate hikes fueled a world-beating rally.

It’s a sharp rebound for a currency that’s been under heavy pressure for most of this year from Sweden’s economic slowdown and real estate implosion. Just over two months ago, the krona plumbed a lifetime low against the euro and was at the weakest for this year versus the greenback.

For November, the currency surged more than 6% against the dollar, the most for a month since September 2010. It strengthened over 3% versus the euro, the best gain since July 2012. The krona was the best performer among the world’s 16 major currencies tracked by Bloomberg.

The rebound comes as the Riksbank’s vowed to deliver another rate hike if necessary, contrasting with major central banks including the Federal Reserve and the European Central Bank that are expected to cut interest rates by more than one percentage point next year.

Peter Kinsella, global head of FX strategy at Union Bancaire Privee, said concerns about the Riksbank’s communication, and Sweden’s “nasty combination of inflation and slowing growth” had justified krona weakness, but these points of pressure are starting to ease, which opened the door for a correction.

But for many analysts and investors, the bulk of gains is now behind as Sweden’s macroeconomic fundamentals remain weak. The nation fell into recession in the third quarter, and the European Commission expects it will be the only member state to see its output decline next year.

The economic weakness, as well as turmoil in a real estate sector that is buckling under increased borrowing costs, has economists doubting how realistic it is that monetary authorities will follow through with another hike next year. Instead, most analysts expect the Riksbank’s next move to be a cut, which market pricing suggests could come as early as June.

Stefan Mellin, chief analyst at Danske Bank A/S in Stockholm recommends selling the krona into any further strength. While acknowledging the potential for a short-term boost from year-end demand, he called the November rally “a respectable correction” rather than a major turnaround.

Options pricing shows traders remain bearish on the krona, albeit with lower conviction than earlier this year. One-month risk reversals in the dollar-krona pair, a barometer of market positioning and sentiment, trade around 50 basis points in favor of the greenback, compared to a year-to-date average of 106 basis points.

Currency analysts also see more weakness in the medium term. While the krona is already stronger than the median forecast for the end of the year, the estimate for the first quarter of 2024 is at 10.70 per dollar, about 2% weaker than the current 10.5 level. Against the euro, expectations are for the krona to slip to around 11.50 by the end of March.

Another source of concern is that the krona could lose a key support early next year, when the Riksbank is expected to end the foreign currency sales that began in late September. While the central bank said the operations aim to hedge against its expectations for an eventual krona recovery, many in the market see the currency benefiting from the flows.

ING Bank FX strategist Francesco Pesole reckons the end of the hedging operations in the coming months is a key reason the krona might struggle to appreciate early next year. Strong resistance lies beyond 10.2 per dollar, a level the krona has failed to break on numerous occasions in the past year or so, he added.