Chinese stocks staged a sudden rally late on Tuesday, with several traders attributing the rebound to technical reasons in the absence of any fresh triggers.

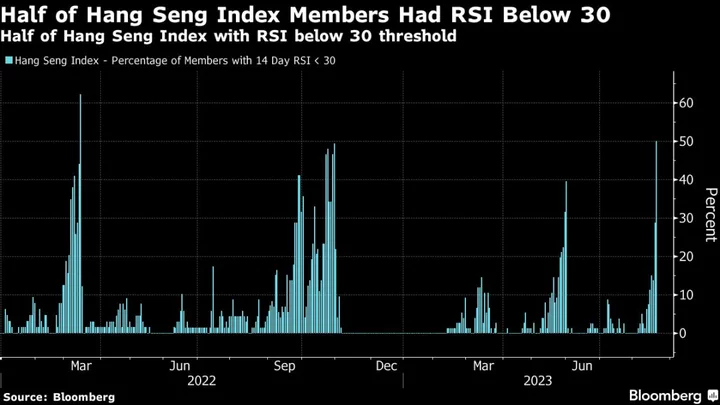

In Hong Kong, the Hang Seng Index climbed nearly 2% within minutes, after a seven-day losing run that was the longest since late 2021. About half of the stocks in the index are now oversold, the highest ratio since March 2022. The CSI 300 Index, benchmark for mainland shares, finished up 0.8% after erasing loss of as much as 0.7%. The gauge was the most oversold since early June on Monday.

READ: Half of Hong Kong Stocks Are Oversold as Bear Market Takes Hold

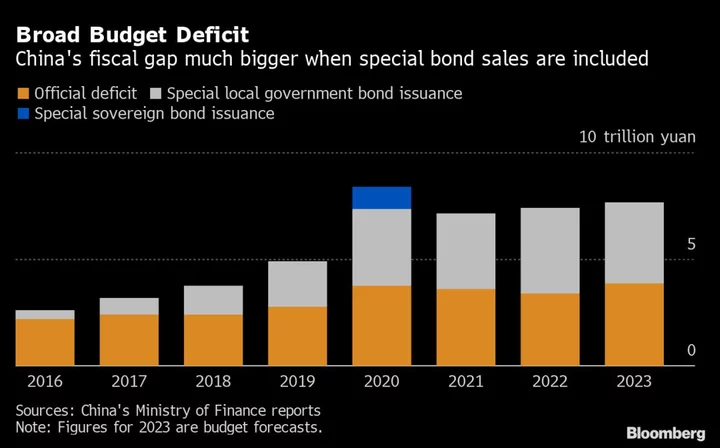

Speculation was rife as stocks jumped, with many market participants talking about the possibility of buying by state-backed funds. The CSI 300 gauge dropped in each of the last two weeks and previous incidents have shown that purchases by the so-called “national team” helped slow losses. Some other traders cited a Caixin report from Saturday, which said China is considering stronger action to address risks from local government financing vehicles.

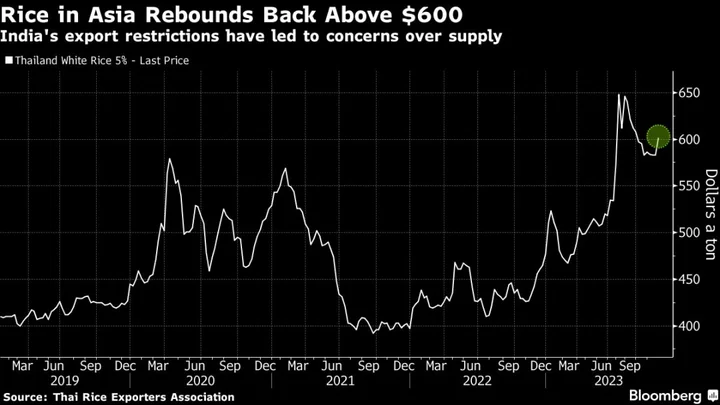

Tuesday’s gains came after investor sentiment toward Chinese stocks deteriorated in recent weeks, owing to dismal economic data, deflation fears, and a property market slump that’s now threatening a crisis in the shadow banking sector.