Asian stocks are pointing to a mixed start after Wall Street largely looked through a US inflation report, reinforcing bets the Federal Reserve may pause its rate hikes but signal it’s not over yet.

Equity futures contracts for Hong Kong and Australia pointed to slight losses while those for Japan showed a gain. Australian bond yields opened lower, following US Treasuries with Japanese bond traders closely monitoring a sale of 20-year securities amid speculation the Bank of Japan may take steps to normalize policy.

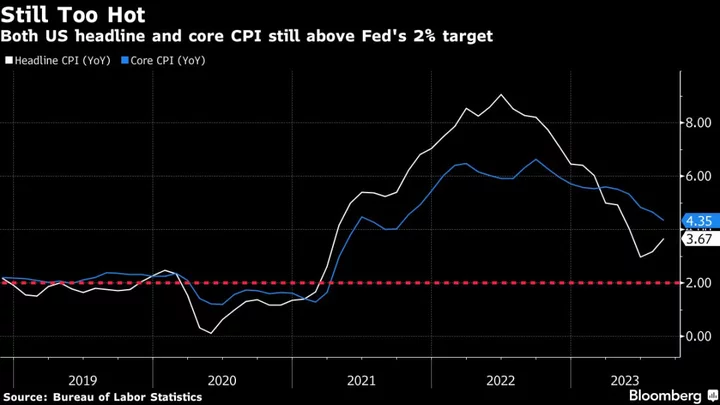

In the US, two-year Treasury yields dropped below 5% and the greenback edged lower. The core consumer price index, which excludes food and energy costs, advanced 0.3% from July, the first acceleration in six months. From a year ago, it increased 4.3% — in line with estimates and marking the smallest advance in nearly two years. It’s still above the Fed’s 2% goal.

Swaps tied to the next two Federal Open Market Committee meetings continued to price in little chance of a hike next week — and about 50% odds of one in November.

“While the markets believe the Federal Reserve is done with its rate hiking cycle, the likelihood of another rate increase cannot be dismissed,” said Janet Mui, head of market analysis at wealth manager RBC Brewin Dolphin in London. “More importantly, the recent data releases suggest interest rates will remain high for some time.”

The S&P 500 was little changed while the Dow Jones Industrial Average underperformed. American Airlines Group Inc. led US stock losses after cutting its earnings outlook amid a jump in jet fuel prices. Most megacaps rose, with the chiefs of five of the 10 biggest US companies appearing at a closed-door Senate meeting to shape how artificial intelligence is regulated. Apple Inc. fell as China flagged security problems with iPhones.

Arm Holdings Plc priced its initial public offering at the top end of its range to raise $4.87 billion in the largest listing of the year, while United Auto Workers President Shawn Fain said talks with major Detroit automakers for a new labor contract are still far apart.

In Asia, distressed Chinese developer Country Garden Holdings Co. is approaching another deadline for voting by bondholders on its request to extend repayment, after winning such support on 10.3 billion yuan ($1.4 billion) of other local notes.

Markets will now look toward the European Central Bank policy meeting and upgraded inflation forecasts Thursday as evidence builds Europe is facing persistent cost pressures that’s been made worse by soaring energy prices. Money markets are pricing in an two-thirds chance the ECB raises interest rates by a quarter of a percentage point, a rapid shift from earlier this month where traders were firmly in the camp rates would be held steady.

“It will be a close decision,” said Imre Speizer, a strategist at Westpac Banking Corp. in Auckland. “Inflation persistence is likely to feature in the ECB’s upgraded projections” with core prices more stubborn, he wrote in a note to clients.

In commodities, oil reversed Wednesday’s losses while gold traded little changed after losses in the last two sessions.

More Comments on US CPI:

- Chris Zaccarelli, chief investment officer at Independent Advisor Alliance:

“This isn’t the goldilocks number that investors were hoping for, but markets can still trade in a range – as inflation is high enough to keep the Fed still in play — but not hot enough for a shift away from the ‘Fed is almost done’ narrative.”

“As long as the economy remains resilient and inflation doesn’t reignite, the market can rally into year-end, once we get past the seasonally weak months of September and October.”

- Mike Loewengart at Morgan Stanley Global Investment Office:

“Today’s middle-of-the-road CPI report may have disappointed those who were looking for inflation to establish a clear cooling trend. But given how high oil prices are and how strong recent economic data has been, the fact that the numbers were more or less in line with estimates may be seen as a small victory. There will continue to be bumps in this road, but the Fed is still on track to leave interest rates unchanged after next week’s policy meeting.”

- Damian McIntyre, portfolio manager for alternative equities at Federated Hermes:

“Today’s US CPI report wasn’t earth-shattering. This print likely makes a case for another pause for the FOMC in September, but provides little clarity into Fed action beyond this. We expect conflicting pronouncements from the Fed heading into the autumn and consensus over the best path forward is unlikely, creating the potential for a contentious November meeting.”

- John Leiper, chief investment officer at Titan Asset Management:

“It’s tempting to read too much into the month-on-month data in this hyper data-dependent central bank age. I think this doesn’t move the needle too much. We still expect the Fed to hold on rates at the next meeting. Markets are pricing in slightly higher chance of another hike later this year.”

- Greg Wilensky, head of US fixed income at Janus Henderson Investors:

“While these numbers do not change our, and the market’s expectations that the Fed will hold the target Fed Funds rate unchanged at the September meeting, the slightly stronger number can influence the tone of the press conference and Summary of Economic Projections.”

“We continue to expect some reduction in the number of participants projecting further hikes, but probably not enough to move the median projection of one more rate hike. That said, we believe that we have likely seen the last rate hike for this cycle, as the economic data that the Fed will see over the coming months will keep them on hold and allow the impact of 5.25% of prior hikes to slow the economy and inflation.”

- Florian Ielpo at Lombard Odier Asset Management:

“This inflation report places the Fed in a more comfortable wait-and-see situation: the marginally higher than expected inflation comes from the evolution of energy prices – nothing the Fed should be worrying too much about at the moment.”

- Brian Pietrangelo at Key Private Bank:

“In our view, the economy maintains decent momentum, but is showing signs of slowing, and thus the Federal Reserve is likely to pause next week and wait for additional data to unfold for the November meeting.”

- Hussain Mehdi, macro and investment strategist at HSBC Asset Management:

“The upside surprise to the August core monthly print will be a disappointment for Fed policymakers. However, the broad trend of disinflation remains intact while there is ongoing evidence of a cooling labor market. This means there is still a strong case for a pause at next week’s Fed meeting.”

“In our view, we believe there is room for further gains for US equities this year. But we think the economic reality of restrictive monetary policy will eventually catch up with the market. A likely tip into recession next year will damage the outlook for corporate earnings and can weigh on multiples. For this reason, we think a cautious and defensive positioning in portfolios still makes sense.”

- Seema Shah, chief global strategist at Principal Asset Management:

“The inflation print likely is not enough to tilt next week’s Fed call towards a hike, yet it also hasn’t entirely cleared up the question of a November pause versus hike.”

Key events this week:

- Japan industrial production, Thursday

- European Central Bank policy meeting and news conference by President Christine Lagarde, Thursday

- US retail sales, PPI, business inventories, initial jobless claims, Thursday

- China property prices, retail sales, industrial production, Friday

- US industrial production, University of Michigan consumer sentiment, Empire Manufacturing index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures edged 0.1% higher as of 8:26 a.m. Tokyo time. The S&P 500 was little changed

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.4%

- Nikkei 225 futures rose 0.6%

- Hang Seng futures fell 0.1%

- S&P/ASX 200 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0733

- The Japanese yen rose 0.1% to 147.28 per dollar

- The offshore yuan was little changed at 7.2712 per dollar

- The Australian dollar was little changed at $0.6423

Cryptocurrencies

- Bitcoin was little changed at $26,223.13

- Ether rose 0.2% to $1,607.03

Bonds

- Australia’s 10-year yield declined two basis points to 4.12%

Commodities

- West Texas Intermediate crude rose 0.2% to $88.72 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.