Stocks in Asia fell and the dollar strengthened Thursday after the Federal Reserve signaled interest rates will be higher for longer.

Benchmark indexes declined, with a regional equity gauge set to post its biggest loss in almost a month. The MSCI China Index fell 1.4% and headed for the lowest close since November as pessimism persisted about the nation’s economic recovery. Tech stocks in Hong Kong slid over 2%, following losses on Wall Street, with contracts for US benchmarks drifting lower in Asian trading.

One bright spot in Asia were Chinese property developers which rose after new measures to ease home-buying rules.

Signs of improvement in Chinese real estate could spur Chinese stocks higher given the steep declines this year James Wang, the Head of China Strategy at UBS Group AG’s investment research unit, said on Bloomberg Television.

“If property sales in China can stabilize and improve a little bit from where we are, and people see that trend continue, that makes investors feel a lot better,” Wang said.

Australian and New Zealand bond yields surged, tracking moves Wednesday in Treasuries as rates hit multi-year highs. Treasury two-year yields, which are more sensitive to imminent Fed moves, hit the highest since 2006 and inched higher on Thursday.

The dollar rallied against major currencies, but was flat against the yen, which traded around 148 per dollar after weakening on Wednesday to the lowest level since November.

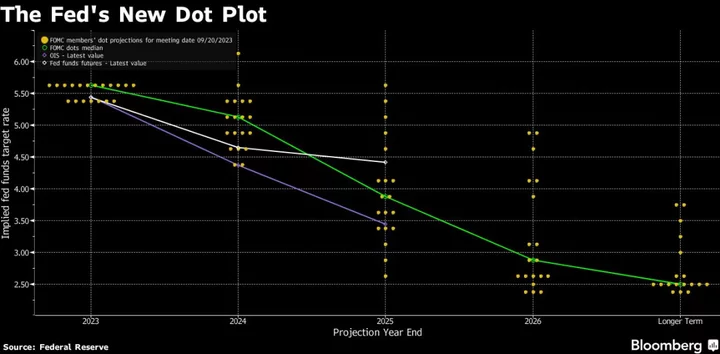

The Fed held its target range at 5.25% to 5.5%, while updated quarterly projections showed 12 of 19 officials favored another rate hike in 2023. Policymakers also see less easing next year, with the median forecast for the federal funds rate at 5.1% by year-end, up from 4.6% when projections were last updated in June.

“The dot plot was more hawkish than expected,” said John Vail, chief global strategist for Nikko Asset Management Co. in Tokyo.

The stronger dollar added pressure on the yen, heightening the prospect of official support for the Japanese currency, Vail said. “Japan’s Ministry of Finance is likely to intervene in large fashion at 150 per dollar because it is hard to tolerate more inflationary pressure.”

“The new projections suggest that the Fed has a fairly strong degree of confidence in its outlook for a soft landing and, in turn, that there will be very minimal space for policy easing next year,” said Seema Shah, chief global strategist at Principal Asset Management.

Swap contracts priced in greater-than-even odds of another quarter-point hike this year and fewer rate cuts next year than previously anticipated.

Central banks will be in focus Thursday as well, with officials in the Philippines, Indonesia and the UK set to announce policy decisions. The Phillippines central bank is likely to lift rates by a quarter point, while Indonesian policymakers are seen keeping rates on hold, according Bloomberg Economics.

After UK inflation unexpectedly slowed, traders pared bets on further tightening steps by the Bank of England, with the market pricing a 50% chance of a quarter-point hike later Thursday. They are also betting that if the BOE does hike, it will be its last. Goldman Sachs and Nomura went further, saying rates have already peaked. Bloomberg Economics expects an increase.

“There is now a real possibility the BOE pauses its hiking cycle this month or, perhaps more likely, raises rates while sending a signal that it thinks the move will be the last of the cycle, according to economists Dan Hanson and Ana Andrade.

The series of policy meetings this week will wrap up with the Bank of Japan on Friday.

Elsewhere, oil’s breakneck rally is taking a breather as a smaller-than-expected drop in US crude stockpiles bolstered technical resistance to further gains, with West Texas Intermediate’s futures dropping below $90 a barrel.

Key events this week:

- Eurozone consumer confidence, Thursday

- Bank of England policy meeting, Thursday

- US leading index, initial jobless claims, existing home sales, Thursday

- China’s Bund Summit, Friday

- Japan CPI, PMIs, Friday

- Bank of Japan rate decision, Friday

- Eurozone S&P Global Eurozone PMIs, Friday

- US S&P Global Manufacturing PMI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.3% as of 12:38 p.m. Tokyo time. The S&P 500 fell 0.9%

- Nasdaq 100 futures fell 0.4%. The Nasdaq 100 fell 1.5%

- Japan’s Topix fell 0.8%

- Australia’s S&P/ASX 200 fell 1.2%

- Hong Kong’s Hang Seng fell 1.3%

- The Shanghai Composite fell 0.6%

- Euro Stoxx 50 futures fell 1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $1.0637

- The Japanese yen was little changed at 148.28 per dollar

- The offshore yuan was little changed at 7.3103 per dollar

- The Australian dollar fell 0.6% to $0.6411

Cryptocurrencies

- Bitcoin fell 0.3% to $27,009.3

- Ether fell 0.2% to $1,620.85

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.43%

- Japan’s 10-year yield advanced two basis points to 0.740%

- Australia’s 10-year yield advanced nine basis points to 4.30%

Commodities

- West Texas Intermediate crude fell 0.7% to $89.06 a barrel

- Spot gold fell 0.1% to $1,928.35 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Stephen Kirkland and Tassia Sipahutar.