Europe’s stagflation crisis and a property downturn in China are flashing a familiar message: for equity investors, there is no real alternative to the US stock market.

With four months left of 2023, returns on the S&P 500 boast about an eight percentage-point lead over the Stoxx Europe 600. The index is on course for its eighth year of outperformance in the past decade, as the artificial intelligence buzz overshadows economic recession fears and pricey valuations.

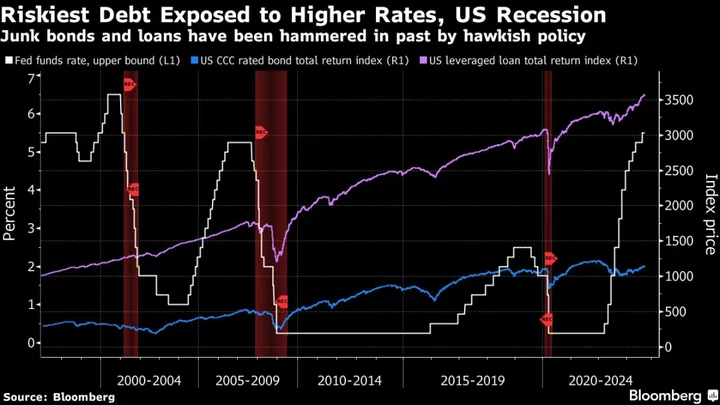

What’s more, the Federal Reserve’s policy-tightening has cooled inflation while managing to keep the economy growing at just over 2%. Data Friday reinforced that soft-landing picture, showing a pick up in labor hiring and a slight slowdown in wage growth.

“US stocks are the place to be,” said Max Kettner, chief multi-asset strategist at HSBC Holdings Plc, who recommends using any S&P 500 pullback to buy.

“It’s the economic resilience, the tailwinds from the weaker dollar, still fairly downbeat expectations on earnings. All of that plays in favor of the US,” Kettner added, in a reference to the view that dollar strength has finally topped out.

In contrast, higher interest rates threaten to tip Europe into 1970s-style stagflation, with the economy sinking into a downturn and inflation running above 5%. In China, it remains unclear whether drip-feed stimulus can revive an economy in deflation. That’s accelerated an investor exodus from both regions.

Investors have fled European equity funds for 25 weeks straight, Bank of America Corp. says, citing EPFR Global data, while Germany’s DAX, home to the region’s manufacturing stalwarts, has just posted its worst monthly performance since December.

Europe does have an edge on share valuations — on a price-to-earnings measure, the Stoxx 600 trades near a record low to the S&P 500. For some strategists such as David Groman at Citigroup Inc., that shows Europe is already pricing the bad news. Citi turned overweight on Europe in July and cut the US to neutral.

Yet, in markets gripped by stagflation fears, the cheapness argument is finding fewer takers.

In such an environment, shares in autos, capital goods, retail, chemicals, banks, semiconductors and leisure — essentially cyclical sectors — are most at risk, the JPMorgan Chase & Co. team led by Mislav Matejka wrote.

Europe loses out on another front. Dominated by so-called old economy stocks, it’s also missed out on 2023’s favorite trade: artificial intelligence. The impact of this is underscored by a single statistic — the market value of the entire 600-member Stoxx benchmark has grown this year by about $810 billion, less than what the poster child of AI, Nvidia Corp., has added.

Tech should benefit even more next year as Treasury yields slide, reckons Nicolas Domont, a fund manager at Optigestion in Paris, and his quest for mega-cap stocks has yielded little outside of Wall Street.

“I was talking with my team about what to buy in Europe as we are predominantly looking for growth and our conclusion was that there really wasn’t much indeed,” Domont added.

Luxury has been Europe’s answer to America’s high-growth, highly valued technology stocks — companies such as LVMH and Hermes International have accounted for a substantial chunk of equity returns this year. But for such names, China’s slowdown poses a hurdle, given it is estimated to contribute up to a fifth of their annual sales.

China Confidence

Within China, problems run deep — even after an interest-rate cut and steps to ease mortgage curbs, the Hang Sang Index was the worst performer last month out of 92 gauges tracked by Bloomberg. Foreign investors offloaded around 90 billion yuan ($12.3 billion) worth of mainland Chinese shares in August, according to data compiled by Bloomberg.

Investors will watch closely how the real estate malaise shapes Chinese consumer spending, with a consumption-related MSCI stocks index trading at around a third of its 2021 peak.

More broadly, the lackluster consumer outlook in China and Europe gives Wall Street bulls another reason to stay close to the US market, where a resilient labor market lifted inflation-adjusted consumer spending by a solid 0.6% last month.

Oppenheimer Asset Management’s chief investment strategist John Stoltzfus recently upped his forecast for the S&P 500, citing the soft-landing view. He now sees the gauge ending the year at 4,900 points, representing an upside of about 9% from current levels.

“We wouldn’t bet against the American consumer and we wouldn’t bet against American business and the American economy,” Stoltzfus told Bloomberg Television this week.

--With assistance from Julien Ponthus.

Author: Sagarika Jaisinghani, Elena Popina and April Ma