SoftBank Group Corp. shares dropped after its Vision Fund investment arm lost money again in the latest quarter ended, despite a rebound in tech stocks.

SoftBank’s stock fell as much as 3.9% during early trading in Tokyo Friday, in their biggest fall in about two months. Investors were also on the lookout for a buyback, which did not materialize when the company reported its earnings the previous day.

Vision Fund Loses Money Again Despite Tech Rebound (1)

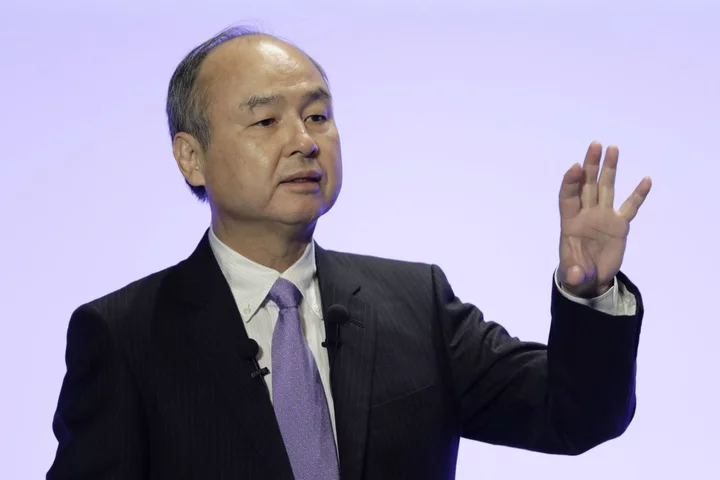

The Vision Fund unit lost ¥297.5 billion ($2 billion) in the three months ended March, compared with a ¥2.2 trillion loss a year earlier. The investment fund that Masayoshi Son proudly set up in 2017 lost a record ¥4.3 trillion for the full fiscal year, almost doubling the record loss of ¥2.6 trillion the year before.

While SoftBank has lost money off and on for years, the latest results are surprising because technology valuations around the world have largely rebounded this year. The Nasdaq 100 index, a benchmark for tech stock performance, rallied 20% during the March quarter, lifting share prices for some of SoftBank’s biggest investments.

The South Korean e-commerce company Coupang Inc., for example, gained about 9%, while the Chinese ride-hailing company Didi Global Inc. rose about 20%. SoftBank accounts for such gains in its portfolio companies as profit on its income statement.

But SoftBank marked down the value of its private companies far more than the increases in its public holdings. It lost about $3.9 billion on its private portfolio during the quarter, while it gained about $1.9 billion with public companies.

SoftBank’s startup investments came to a halt during the year, with Vision Fund investments falling more than 90% to just $3.14 billion. Goto explained that SoftBank has been careful to keep plenty of cash on hand to cover debt and other obligations, in part by selling off most of its holdings in Alibaba Group Holding Ltd.