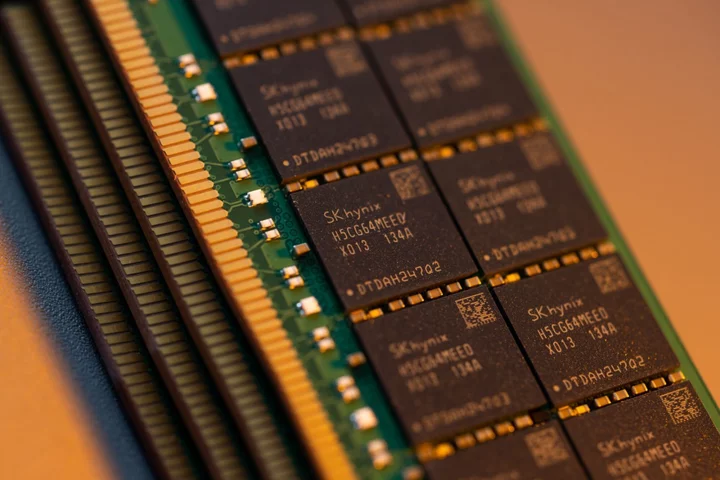

SK Hynix Inc. declared its opposition to a merger of Kioxia Holdings Corp. and Western Digital Corp., introducing more uncertainty to a landmark US-Japanese deal years in the making.

The world’s No. 2 memory chipmaker, a shareholder in the Japanese chipmaker, says the transaction undervalued its stake.

SK Hynix “is not agreeing to the deal at this time in light of the overall impact on the value of the company’s investment” in Kioxia, Chief Financial Officer Kim Woohyun told analysts on a post-results call.

Western Digital and Kioxia have talked for years about a possible combination, yet discussions have been snarled over issues of control, leadership, economics and politics. In theory, merging the two operations would help the companies compete against the memory chip industry’s largest players.

Read more: Kioxia Is Said to Approach JIC to Back Western Digital Deal

The pair now seek to wrap up negotiations this month and want to announce a deal no later than when the US firm reports earnings Oct. 30. Kioxia has approached Japan Investment Corp. about making a capital infusion to speed up the deal.

SK Hynix, a competitor in the memory chip business, became an indirect shareholder in Kioxia when a Bain Capital-led consortium bought a controlling stake from Toshiba Corp. It’s not clear yet how its objections will affect the outcome.

An agreement could get announced despite the company’s resistance, as Bain and Kioxia work on a resolution, people close to the matter have told Bloomberg News. While multiple people said SK Hynix has no veto rights over the deal, others said the company’s consent is necessary because it’s a major investor.

Read more: SK Hynix Sales Decline Slows in Sign of Recovery for Chips

--With assistance from Seyoon Kim and Sohee Kim.