Sinopec’s first-half profits shrank amid lower oil prices and fuel demand being weighed down by China’s sluggish economic recovery.

China Petroleum & Chemical Corp., as it’s officially known, posted net income of 36.12 billion yuan ($4.96 billion) in the first six months, according to international financial reporting standards. That compared with 44.5 billion yuan over the same period in 2022.

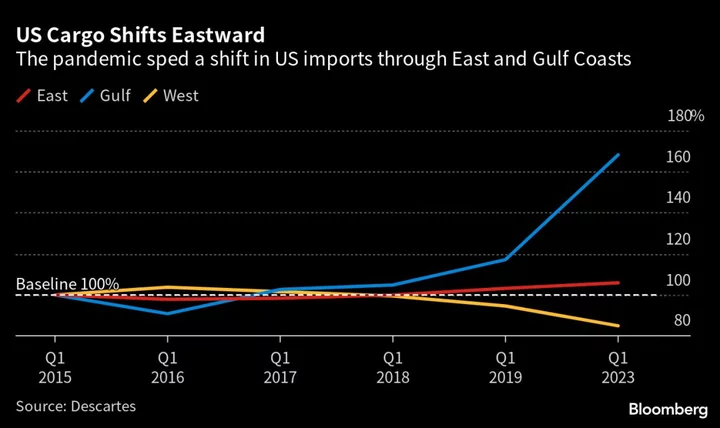

Sinopec, China’s largest fuel-maker, saw domestic sales of refined oil products rise 18% in the first half from the previous year, when residents in megacities like Shanghai were completely locked down for months on end. Still, a lingering property crisis and weaker overseas demand for exports have kept the recovery in check.

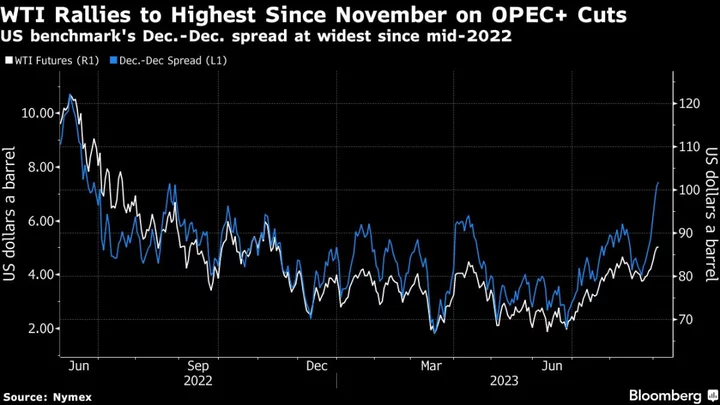

Meanwhile, crude prices were 24% lower than the year before over the first half, reducing the value of Sinopec’s global oil and gas production.

Sinopec’s larger state-owned sister firm, PetroChina Co., will report earnings Wednesday. The country’s offshore driller, Cnooc Ltd., said earlier this month that first-half profit fell on lower oil prices.