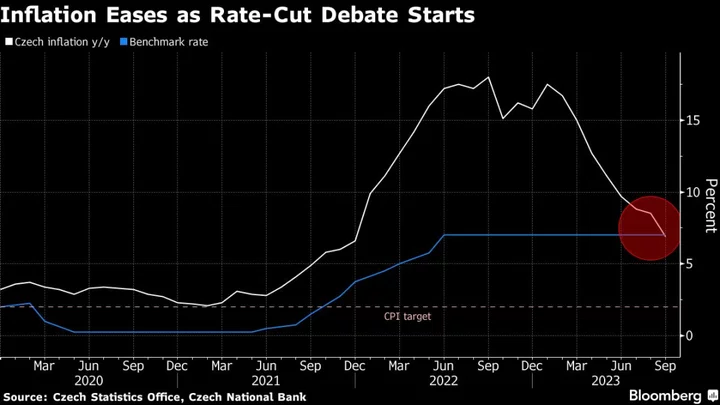

Czech central bankers may announce their first interest-rate cut in more than three years as a swift retreat in inflation and an economic contraction increase the urgency to shift to monetary easing.

Economists surveyed by Bloomberg are almost evenly divided on whether the Czech National Bank will lower the benchmark rate from 7% — the highest level in a quarter century. Eleven expect a quarter-point reduction, while 10 forecast no change. The last cut was in May 2020.

Policymakers in Prague have weighed up the optimal timing to begin lowering borrowing costs, with rapidly slowing price growth and anemic demand buoying arguments for a rate cut as early as November. While several have said easing may start this year, they’ve also warned that the tight labor market and a weakening in the koruna warrant caution.

The Czech Republic’s $300 billion economy unexpectedly shrank in the third quarter, with the drag coming from weaker exports and sluggish household consumption. Consumer price growth also eased more than the central bank forecast, with an outlook for a sharp drop to within the 1%-3% tolerance range early next year.

“Weaker GDP could support our call for the CNB cutting its policy rate by 25 basis points in November,” said Jaromir Sindel, chief economist at the Czech unit of Citigroup Inc. “There are still some upside inflation concerns that are likely to keep a hawkish tilt in the CNB’s communication.”

The policy announcement is scheduled for 2:30 p.m. in Prague, followed at 3:45 p.m. by Governor Ales Michl’s briefing and presentation of the highlights of fresh staff forecasts.

Money markets are pricing in quarter-point cuts at both the November and December meetings, with investors betting that the central bank will rapidly slash the benchmark to about 3.75% by by the end of next year.

Last week, board member Jan Kubicek said he might consider voting for a cut in November, although inflation risks still gave him pause — and a potential decision to hold off until December “wouldn’t be a serious mistake.” He added that most of the rate-setting panel preferred to start easing in small and gradual steps.

Jiri Polansky at Ceska Sporitelna AS said the Czechs were “slightly” more likely to delay the start of policy easing until December, although the GDP data had raised the odds of a rate cut happening this week.

“Board members will probably only decide during the meeting based on the discussion,” he wrote in a report. “If the CNB holds rates in November, this will increase the risk that it will have to accelerate cuts in December or early next year, given the disinflationary developments.”