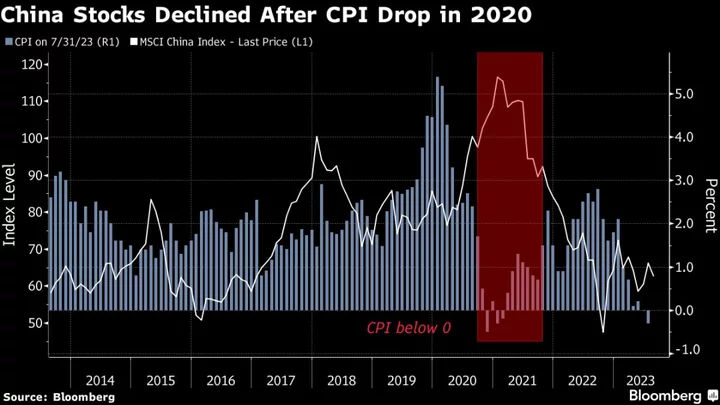

Shimao Group Holdings Ltd. slumped by the most ever as trading resumed following a 16-month halt and the defaulted Chinese developer disclosing steep losses the past two years in long-delayed results, underscoring the sector’s lingering financial stress.

Shares traded as much as 58% lower in Hong Kong. They had last traded on March 31 of last year, before Shimao failed to publish unaudited 2021 results. During the trading halt, a Bloomberg Intelligence gauge of the sector dropped 32%.

Shimao Group Posts Losses of $6.8 Billion Over Two Years (1)

The builder was facing an end—of-September deadline to release the 2021 financials or face possible delisting. Earlier this month, a $1.8 billion project by Shimao failed to find a buyer at a forced auction, underscoring its difficulties liquidating assets amid a weakening property market.

Shimao’s dollar bonds were little changed Monday morning, remaining at around 8 cents, according to prices compiled by Bloomberg.

The builder, unlike larger peers including China Evergrande Group and Sunac China Holdings Ltd., has yet to present a debt-restructuring plan. Shimao, which first defaulted on a dollar bond last July, said earlier this month that it was working with advisers of an ad-hoc group of holders.

Meanwhile, a rally in Chinese property shares continued Monday as the BI gauge climbed more than 20% from a low set just one week ago. Since then, the sector surged as Chinese leaders made stronger pledges to revive an ailing economy by stimulating private consumption and easing housing curbs.