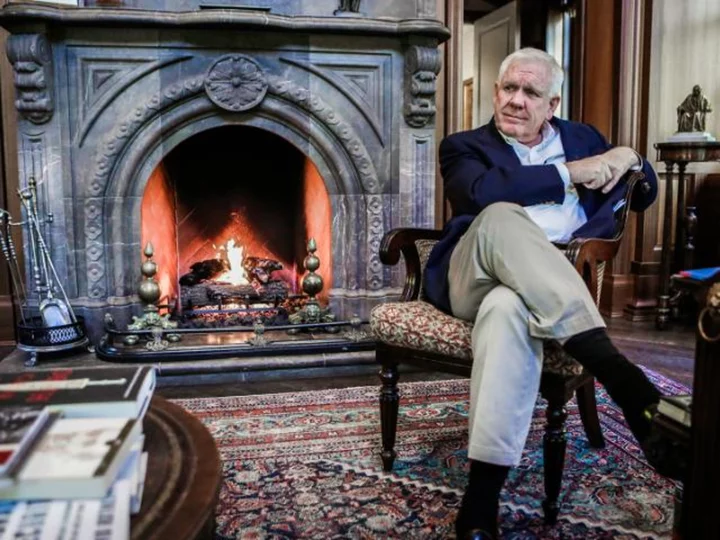

Senate Finance Chairman Ron Wyden is pushing back on assertions from GOP megadonor Harlan Crow that the panel lacks authority to request personal tax information and travel records from him as part of a probe into whether hospitality he provided to Justice Clarence Thomas could have triggered violations of US tax law.

In a letter sent Wednesday to Crow's attorney, the Oregon Democrat asked the Texas billionaire's team to provide a number of documents to the committee by June 2. Democrats on the Senate Finance Committee met earlier this week and discussed issuing a subpoena if Crow does not comply with the requests, a source familiar with the matter told CNN.

Crow, who paid for luxury travel for Thomas, declined earlier this month to answer questions Wyden raised about whether the hospitality Crow provided Thomas or a private 2014 real estate deal with Thomas' family could have triggered violations of US tax law.

Wyden has argued he needs the information in order to look at changes to the country's gift tax.

"I believe that tax laws affecting enormous gifts and transfers of wealth by high net individuals are in urgent need of reform. I also believe that, when appropriate, congressional oversight should be done in a manner that informs the public of the policy implications of the behavior being investigated," Wyden wrote in the letter to Crow's attorney on Wednesday.

Wyden disputed an assertion from Crow's lawyer that the senator lacks a legitimate legislative purpose for his request and doubled down on his request for Crow to provide information, including a "detailed" list of flights Thomas has taken on "any private jets under Mr. Crow's ownership or control"; any reimbursements made by Thomas for his travel; an accounting of all the times Thomas traveled or was a guest on Crow's yacht; and a "detailed accounting of federal gift tax returns."

Wyden has raised the possibility that the hospitality may have required disclosure on federal tax filings, which generally require taxpayers to report gifts in excess of a certain amount. The letter also indicated an interest in examining whether the travel was recorded on tax records as a business expense.

Wyden has raised the possibility that the hospitality may have required disclosure on federal filings, which generally require taxpayers to report gifts in excess of a certain amount. The letter also indicated an interest in examining whether the travel was recorded on tax records as a business expense.

"We have serious concerns about the scope of and authority for this inquiry," Michael Bopp, a lawyer for Crow, said in a letter to Wyden earlier this month.

"Given the Letter's timing and focus, this inquiry appears to be a component of a broader campaign against Justice Thomas and, now, Mr. Crow, rather than an investigation that furthers a valid legislative purpose," Bopp wrote.

A source close to Thomas previously told CNN that the justice plans to amend his disclosure forms to reflect the real estate transaction, which also went unreported.