The US Securities and Exchange Commission’s lawsuit against crypto exchange Binance and its head Changpeng Zhao injects fresh uncertainty into a sector that’s struggling to maintain mainstream relevance.

The SEC accused Binance Holdings Ltd. and Zhao of mishandling customer funds, misleading investors and regulators, and breaking securities rules. The action adds to the regulatory heat on the largest digital-asset trading platform. It’s also another black eye for crypto after a rout in 2022 that contributed to rival FTX’s downfall amid a flurry of fraud allegations.

The market faces an uphill task to restore trust and, meanwhile, investors are moving on to themes like artificial-intelligence stocks. The overall value of digital coins has plunged to $1.1 trillion from a peak of over $3 trillion in 2021, when giant stimulus fueled a pandemic-era boom in tokens such as Bitcoin.

Jane Street Group, Jump Trading and other major trading firms have pulled back from crypto in the US amid heightened regulatory scrutiny. The ensuing decrease in liquidity can pose an obstacle for investors by making it harder to get into and out of digital-asset investments in an orderly way.

‘Very Different’

“The industry will be very different in a year,” Markus Thielen, head of research at Matrixport, wrote in a note. “Trading volumes will likely drop further and pressure market makers’ revenue projections. Crypto in the US will continue to go through a nuclear winter.”

The SEC in the complaint cited 12 coins as assets that fall under its purview, expanding the list of tokens deemed unregistered securities to span more than $115 billion worth of crypto. That implies strict rules should apply, which could make the tokens harder to trade if exchanges shy away from listing them.

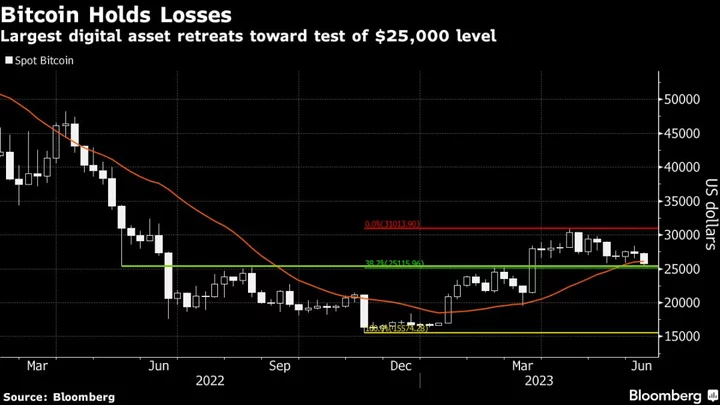

Digital-asset prices Tuesday largely held a drop sparked by the lawsuit. An index of the top 100 coins has shed about 4% since the complaint hit Monday. Bitcoin, the largest token, has fallen closer to the $25,000 level.

The net outflow from the Binance exchange reached $702 million on Monday, the highest since February, according to a Dune Analytics dashboard from exchange-traded products issuer 21Shares AG.

Binance called the SEC action “disappointing,” saying it had engaged with the agency in good-faith negotiations to settle the matter.

“While we take the SEC’s allegations seriously, they should not be the subject of an SEC enforcement action, let alone on an emergency basis,” the firm said. “We intend to defend our platform vigorously.”

The exchange faces a web of probes, including a lawsuit by the US Commodity Futures Trading Commission. Action by the US Department of Justice “against Binance and/or related entities or individuals might not be too far behind,” Bloomberg Intelligence’s Senior Litigation Analyst Elliott Stein wrote in a note.

Boom, Bust

For some crypto experts, the sector is merely following an expected if pronounced boom and bust cycle. They point to a 56% rebound in Bitcoin this year as evidence that healing is under way.

“As recently as March, SEC attorneys were publicly saying that Binance was running an unregistered securities exchange, and so we knew this day was coming,” said Noelle Acheson, author of the Crypto Is Macro Now newsletter. “To some extent we could see some relief that this shoe has finally dropped.”

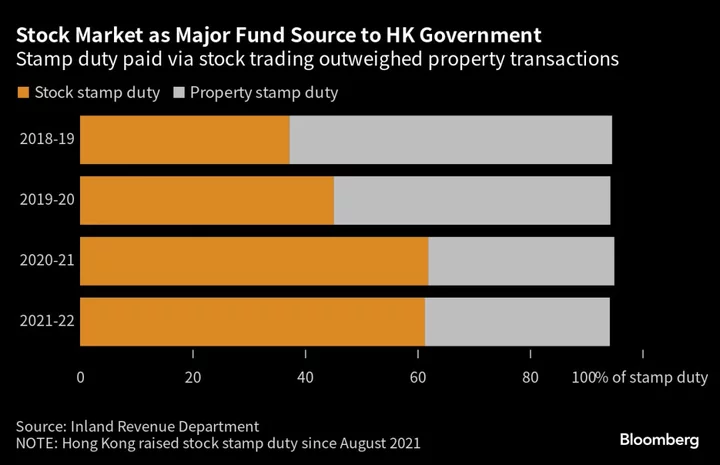

Outside the US, locations such as Hong Kong and Dubai are seeking to court crypto investment. The European Union in April approved the most comprehensive digital-asset rules of any developed economy.

That potentially gives crypto firms friendlier places to try and recover from a deep retrenchment and learn the lessons of last year’s crash. “The lack of US regulatory clarity will drive crypto to other jurisdictions,” said Cici Lu, founder of blockchain adviser Venn Link Partners.

--With assistance from Akshay Chinchalkar.