Ilija Batljan, the founder and dominant shareholder of embattled Swedish landlord SBB, stepped down as chief executive officer in a dramatic move that highlights the uphill battle he faces to save his $13 billion empire.

Batljan, who founded Samhallsbyggnadsbolaget i Norden AB in 2017, will hand off executive responsibility as of June 5, the Stockholm-based company said Friday in a statement. He will be replaced by Leiv Synnes, who has served as chief financial officer of Akelius Residential Property AB since 2014. Shares soared as much as 69% after trading resumed in Stockholm.

“As the founder and a major shareholder in SBB, it is my role to take responsibility in a challenging time,” Batljan, who will remain on the board of directors, said in the statement. “My faith in SBB is intact.”

Batljan, 55, was the driving force behind SBB’s rapid, debt-fueled expansion and became the center of the company’s turmoil. His credibility was damaged after a series of statements dismissing the company’s vulnerabilities. Just days before a downgrade of the company’s credit rating to junk status, he had boasted that SBB met “all the criteria” to have S&P Global Ratings drop its negative outlook.

Read More: The Face of Sweden’s Property Bust Fights for $13 Billion Empire

In building his empire, Batljan’s bravado and a pledge to increase dividends for “100 years” wooed a loyal following of retail investors. But support was damaged by the tumbling share price and postponed dividend. It’s been a harsh turn of events for a man anointed Sweden’s Entrepreneur of the Year in 2021 by SBB’s accountant EY.

The former war refugee held 8.3% of SBB’s shares and almost 32% of the votes in SBB as of April 26, according to company’s website. His investment firm announced late Thursday that it will postpone the publication of its quarterly report to June 9 from May 31. Ilija Batljan Invest AB recently skipped interest payments on its hybrid bonds.

The surprise move came after Batljan traveled to the City of London this week and spoke to a number of investors about selling individual assets as well as the whole company, said a person familiar with the process. The Canadian investment group Brookfield Asset Management is among investors involved in early stage talks to evaluate the real estate firm’s portfolio, said other people, who asked not to be identified as the meetings weren’t public.

Analysts see a full sale unlikely and buyer interest is expected to focus on assets such as SBB’s elderly care homes and residential units. The company’s dwindling prospects have also raised political concern, given its ownership of many public-sector buildings.

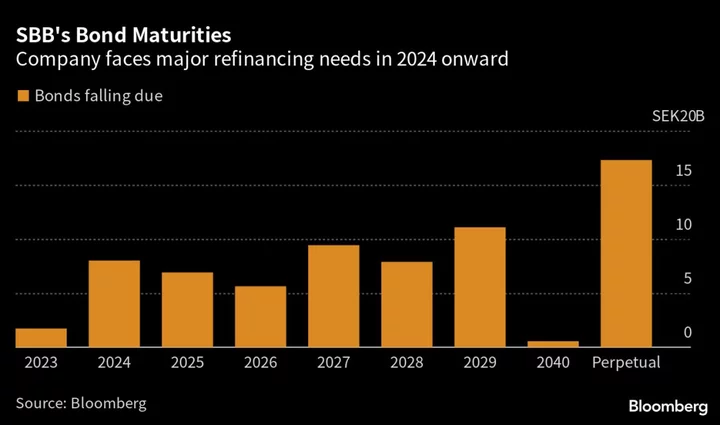

With an $8 billion debt pile and surging interest costs, the company has so far failed to shore up investor confidence. Over the next three years, SBB must roll over $1.6 billion of maturing bonds, making it a test case for European property companies that have borrowed heavily in the era of easy money.

The landlord faces urgency to find cash, and options are narrowing. The company has already paused some hybrid bond coupons, scrapped a dividend and emergency rights issue and has even hired the services of JPMorgan Chase & Co and SEB AB to drum up some support.

The next stage of the rescue effort will fall to Synnes, a 19-year veteran who rose through the ranks of property manager Akelius. The 52-year-old is a low-key industry insider. During his tenure Akelius emerged as the biggest owner of landlord Castellum AB after buying a stake from Rutger Arnhult, another under-pressure CEO. His nomination could strengthen the hand of mogul Roger Akelius.

“With Leiv Synnes as the new CEO, SBB gains a new, highly qualified force that can manage the company with full focus and support the board of directors in the strategic review,” Chairman Lennart Schuss said in the statement.

(Updates with additional details throughout.)