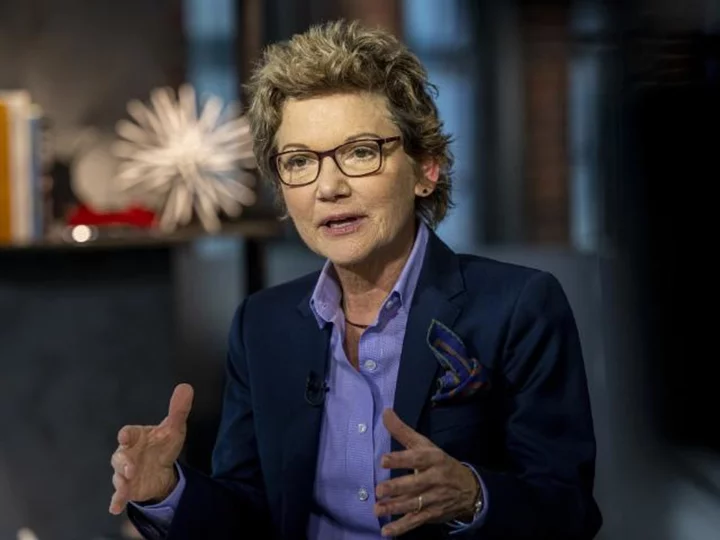

Despite promising signs that inflation is abating, San Francisco Federal Reserve Bank President Mary Daly said the fight against price increases isn't over.

"There is no doubt that the good news on inflation is good news indeed," Daly said in an interview with CNBC on Thursday. But she cautioned, "It's really too early to declare victory on inflation."

The latest Consumer Price Index report published on Wednesday showed that annual inflation slowed from 4% to 3% in June, the lowest level since March 2021. The latest Producer Price Index data, which measures the average change in prices that businesses pay to suppliers, showed annual wholesale inflation cooled last month to the lowest level in nearly three years.

However, the Fed's preferred gauge of inflation, the Personal Consumption Expenditures index, showed that inflation was double its 2% target in May. June's PCE inflation data is due on July 28, two days after the Fed's next meeting concludes.

That said, the Fed seems to have already penciled in another rate hike at its upcoming meeting on July 25-26.

Daly acknowledged there's a risk the Fed will raise rates higher than what's ultimately needed to get inflation down to 2%. That's because it could take at least a year from when the Fed acts to when its actions are felt across the economy. That lag effect is part of the reason why the labor market is just beginning to show signs of cooling in addition to the significantly slower pace of price increases now compared to a year ago, she said.

But Fed officials "can't just hold out hope... that lags are going to solve all our problems," said Daly, who is an alternate voting member this year on the Fed's committee responsible for interest rate decisions.

That's why the central bank has to remain committed to "bring [interest rates] up to a sufficiently restrictive place, and then hold that rate for the time it takes to bring inflation clearly back down to 2%," Daly said.

Daly, who will be voting on interest rates at the Fed's meetings next year, said she wouldn't necessarily consider cutting rates once inflation hits 2%. "I know it isn't that far away to think about when might we start cutting rates. Right now all my attention is on decidedly if we need to hike more and how much more will we need to hike [to get inflation down to 2%]."

Shortly after Daly's remarks on Thursday, St. Louis Federal Reserve Bank President James Bullard announced he is stepping down from his position in mid-August.