The Riksbank paused its tightening campaign, refraining from inflicting a ninth increase in borrowing costs on an increasingly sickly Swedish economy.

Policymakers led by Governor Erik Thedeen left the benchmark interest rate at 4%, in a decision that had split economists. A majority predicted a hike, though eight out of 21 forecasts compiled by Bloomberg anticipated no change.

The central bank underscored the dampening impact of monetary policy on demand and inflation pressures and said it would be prepared to raise its key rate further if needed.

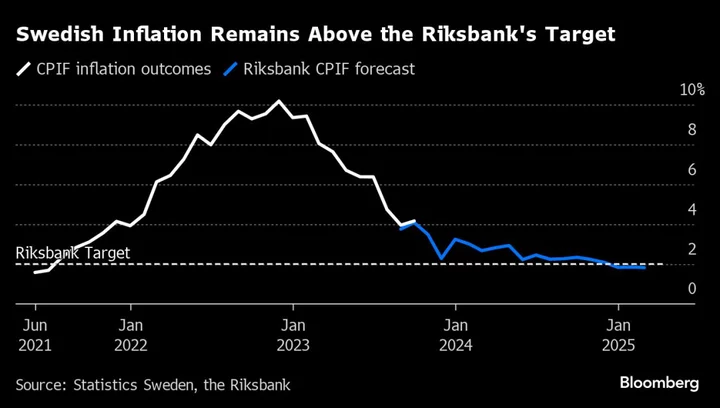

“It’s very clear we have not lost the chance to hike again,” Thedeen said at a news conference in Jonkoping, where the board met this time. “We will do that if inflation does not go in the right direction toward 2%. That is a very clear message from us.”

The decision aligns Sweden’s central bank with peers in the US, euro zone and the UK that have already halted for now. Officials opted not to squeeze the economy further even as the krona’s feebleness risks importing more cost pressures and services price growth remain elevated.

The currency weakened as much as 0.5% after the decision to 11.4515 against the euro at 11:40 a.m. in Stockholm.

The Riksbank still sought to indicate a tightening bias to investors.

“The forecast for the policy rate is that it may be raised further at the start of next year and that monetary policy needs to be contractionary for a relatively long period of time,” officials said. That chimes with global counterparts that have signaled borrowing costs will need to stay higher for longer.

It was also interpreted by analysts as more of a signal than a concrete plan to jack up the cost of credit further.

What Bloomberg Economics Says...

“The Riksbank’s decision to keep rates on hold on Thursday confirms it is done hiking for this cycle — the accompanying hawkish tone is likely to ensure financial conditions do not ease prematurely and will also support the recent strengthening in the krona. The central bank’s next move will probably be a cut in the second half of 2024.”

—Selva Bahar Baziki, economist

The central bank’s policy path implies a peak at 4.1% in April, with reductions starting in the spring of 2025.

“We expect that the Riksbank is now done hiking and forecast the first rate cut in June 2024,” Swedbank AB analysts Jesper Hansson, Carl Nilsson and Glenn Nielsen said in a note. “We don’t think another hike will come, as greater disinflation and a weak economy going forward will lower the need for this.”

The Riksbank’s easing will begin sooner than the rate path implies due to the deteriorating economy and as consumer-price growth is seen reaching levels consistent with the central bank’s target “already next summer,” they said.

“They are buying themselves time through a hawkish framing,” portfolio manager Thomas Pohjanen at Excalibur Asset Management said by email. Waiting until the next meeting on Jan. 31 “will give the bank clues that will guide that decision,” he said. The outcome will be communicated Feb. 1.

The case cited by economists for a ninth hike was stubbornly high inflation, and the vulnerability of the Swedish krona to setbacks after recent strengthening. Analysts acknowledged however that weak economic data and the currency’s recent strengthening also supported arguments for a pause.

The Riksbank is also considering increasing the pace of sales of government bonds, and said it could make a decision on the matter in January. The Riksbank has no plans to begin selling its holdings of non-government bonds, it said.

Tightening started in April last year. The mounting fallout includes a dent in consumption, a plunge in housing construction and a squeeze on some highly leveraged property owners that are struggling to refinance maturing debt.

Thedeen said the troubles of some landlords had no direct impact on the rate decision, and added that the bank hasn’t discussed any measures to alleviate pressure on the sector.

“It is up to the companies to handle their balance sheets and there’s still plenty of room to do that,” Thedeen said. “They cannot count on support from us.”

Even the hitherto resilient labor market is now weakening, and the central bank has come under pressure from labor unions as well as employers’ organizations warning that increasing borrow costs further could harm the nation’s economy unnecessarily.

The Riksbank now expects a 0.7% decline in gross domestic product this year, followed by a contraction of 0.2% in 2024.

--With assistance from Love Liman, Ott Ummelas, Harumi Ichikura, Joel Rinneby, Veronica Ek, Christopher Jungstedt, Stephen Treloar, Charles Daly and Lars Klemming.

(Updates with comments from governor, economist and portfolio manager from fourth paragraph)