Regional banks are poised to return to the debt markets in the biggest wave since June to meet new capital requirements in response to the failures of Silicon Valley Bank and Signature Bank.

If this week’s proposals from the Federal Deposit Insurance Corp. and the Federal Reserve are any indication, larger regional banks will have to issue more long-term debt to protect against losses during periods of turmoil. They will probably need to sell some $40.5 billion of holding-company debt to fulfill the new rules, according to CreditSights, and the first deals are likely to come in the near future, even if lenders may have years to meet the new rules.

Regional and consumer lenders subject to increased oversight will probably issue at least $15 billion of bonds over the remainder of the year, said Peter Simon, a senior analyst at CreditSights. In addition, “there is $44 billion maturing from this group through the end of 2024, so there’s plenty of issuance needed.”

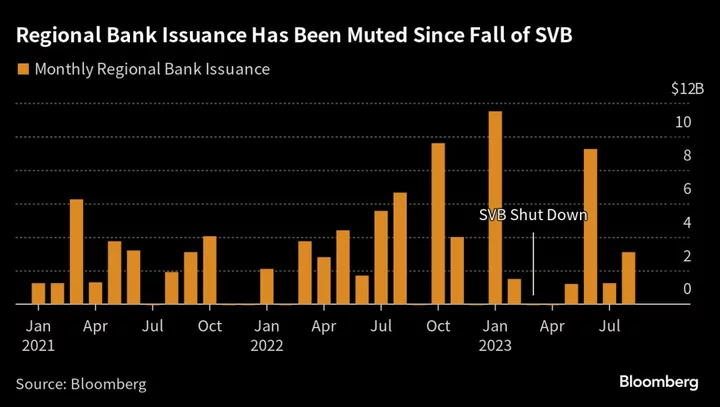

A wave of issuance would mark a departure from recent months, when many smaller banks were reluctant or unable to come to the market. Borrowing was expensive, if possible at all, after the failure of SVB was followed by a barrage of downgrades by ratings companies. Regional lenders sold 40% less debt from March through August than they did in the same period last year, according to preliminary data compiled by Bloomberg News.

“Mid-size regionals that have been a bit shy in terms of tapping the debt markets will need to start coming,” Bloomberg Intelligence credit analyst Arnold Kakuda said.

Tempered Expectations

Under the new rules, banks with $100 billion of assets or more will need to issue enough long-term debt to cover capital losses in times of severe stress, requirements that previously only applied to bigger banks. But the rules are shaping up to be less onerous than previously feared, and banks that aren’t the biggest and most complex won’t need to meet total loss-absorbing capacity requirements. Stricter TLAC rules could have led to a shortfall of about $157 billion in regional bank bonds.

Regardless of size and timing, fixed-income managers are likely to be interested in buying when the lenders do line up fresh debt.

“Given that regionals are the cheapest portion of the investment-grade market, there’s pent-up demand from investors,” said Matt Brill, head of North America investment grade at Invesco, whose group manages $78 billion. “The key point here is that banks can borrow and that investors will be willing to do it at the right price.”

Risk premiums for regional banks in particular are now much less wide when compared with the average blue chip firm than they were in April, when bank failures pushed spreads out. Another positive for the banks: the average borrowing costs for high-grade firms broadly eased this week after yields fell.

Still, some regionals may decide to bide their time beyond the cyclical September rush in the belief that funding costs will fall further.

“Spreads are still wide by historical standards,” said Peter Aherne, co-head of North America debt capital markets at Citigroup Inc. “I’m not sure that banks necessarily feel compelled to rush into this market.”

Week in Review

- The new world of private credit is turning to an old way of raising money, with fund managers increasingly placing debt with insurance companies as public markets become less inviting.

- Embattled Chinese developer Country Garden Holdings Co. warned it may default on its debt after posting a record first-half loss. Creditors in a maturing yuan bond, however, voted late Friday to allow payments to be stretched into 2026, providing some respite.

- Barclays Plc has earmarked cash from its balance sheet to hold corporate loans and compete directly with private credit funds, as more banks look for ways to gain a foothold in the $1.5 trillion market for private debt.

- Banco Santander SA opted not to redeem a €1 billion ($1.1 billion) additional tier 1 bond, an unusual move even amid the turbulent market for bank debt this year.

- UBS Group AG’s CEO said the bank is “looking” at markets for AT1 bonds, while Intesa Sanpaolo SpA is offering to buy back an AT1 bond early and plans to replace it with a new issue.

- Traders that bet against troubled French grocer Casino Guichard Perrachon are pushing to trigger credit default swaps tied to the debt before a chunk of them expire next month.

- Sino-Ocean Group Holding Ltd. won bondholder approval to extend repayment for a yuan note, giving it some breathing room to cope with an industry-wide cash crunch.

- China Evergrande Group delayed creditor meetings to vote on its offshore-debt restructuring plan just hours before they were to occur.

On the Move

- Wilbert Poot has taken over syndicated loan origination from Mick Borms at ABN Amro. The bank also hired Krishan Patel as director for syndicated loan origination.

- Citi has hired Carles Jou as a managing director in loans & leveraged finance, based in London. He spent the last 14 years at Goldman Sachs.

- Investment bank Lazard Ltd. has recruited Daniel Judenhahn as managing director and head of restructuring and debt advisory for the DACH region.

--With assistance from Hannah Benjamin-Cook, Katanga Johnson and Dan Wilchins.