A stock market sector that investors furiously bailed out of just months ago is slowly making a comeback.

Regional bank stocks are notched their fourth weekly gain in a row, tying a January streak as a revival in bond sales from the group reinforced bank resilience. While the sector is far from recouping the losses that Silicon Valley Bank’s collapse in March inflicted, the fresh debt sales mark the latest sign that the sector is buckling down for future pressures while distancing itself from the tumult.

“This is a vote of confidence for the investability of banks,” Wells Fargo’s Mike Mayo said. Equity investors are “inching back” toward the stocks, the analyst added.

Read More: PNC, US Bancorp Add to Post-SVB Regional Bank Bond Sale Revival

The KBW Regional Banking Index rose 3.3% this week on the back of strong rallies Tuesday and Wednesday, bringing the index’s four-week advance to about 18%. Shares of PacWest Bancorp, which had been the worst-performing member of the gauge this year, nearly doubled over that period, paring its yearly plunge to 63%.

“There were a number of data points in Q1 earnings and recent industry conferences that made the dust settle on concerns about deposit flight,” said Phil Stone, managing partner of bank-focused investment management firm Fourthstone LLC.

Investors fled the sector in March, as the collapses of Silvergate Capital Corp., Silicon Valley Bank and Signature Bank stunned markets. Billions of dollars of deposits flew out of regional banks’ doors, and the reverberations ultimately led to the downfall of a fourth regional lender First Republic Bank.

And not everyone’s sold on the bank stock rebound. Individual retail traders didn’t waste any time getting out of the sector as they pivot toward technology and small-cap shares, according to weekly data from Vanda Research.

“It’s a tough sector to be overly constructive on,” said Keefe, Bruyette & Woods analyst Christopher McGratty.

The impacts of office commercial real estate weakness and potential higher capital requirements continue to weigh on investors’ minds. Uncertainties still swirl, while investors are becoming increasingly reassured the shocks have morphed into earnings pressures rather than solvency crises.

Read More: US Banks Face Capital Jump With More Lenders Roped In to Comply

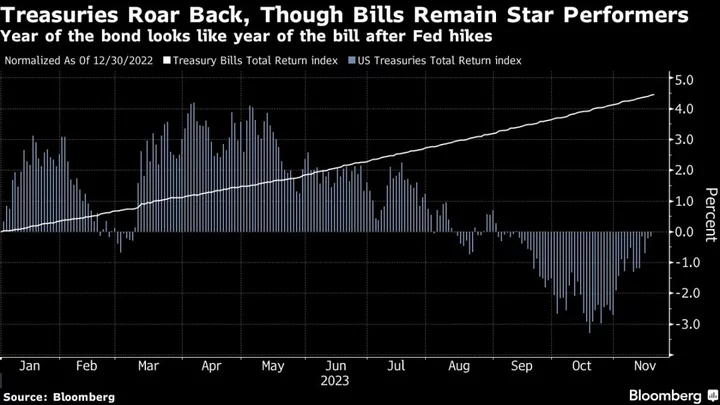

Traders will be closely watching next week’s inflation data and Federal Reserve meeting for clues on what’s ahead for banks and the broader economy.

--With assistance from Bailey Lipschultz and Josyana Joshua.

(Updates stock moves to market close throughout and adds investor and analyst commentary.)