Investors are bracing for Philippine President Ferdinand Marcos Jr.’s choice on who will head the central bank in the next six years, with analysts seeking policy continuity.

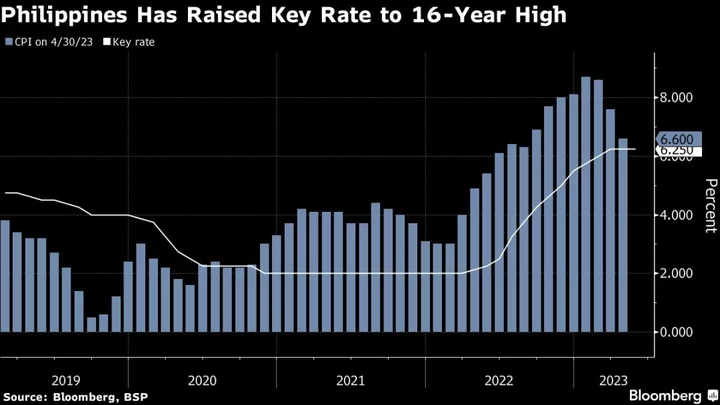

Marcos will determine the Bangko Sentral ng Pilipinas’ leadership in the coming weeks, as Governor Felipe Medalla’s term is set to end by July 3. The president’s choice will steer the central bank after an aggressive monetary tightening campaign to quell inflation that remains elevated.

“Someone who could uphold the tenets of an independent central bank and who has the appropriate experience in the conduct of monetary policy, financial supervision and financial stability would be a good fit for the role,” said Domini Velasquez, chief economist at China Banking Corp.

The 73-year-old governor was appointed by Marcos last year to finish the term of Benjamin Diokno, who moved from the central bank to head the Finance Department.

Medalla has led the BSP in raising its policy rate to a 16-year high in the past year, as domestic and global headwinds pushed inflation way beyond the central bank’s 2%-4% goal. His latest signals point to an extended pause on policy moves as price pressures ease, propping up the Philippine peso.

“A change of BSP leadership after just a year would be disruptive, particularly after Medalla’s forward guidance has helped guide market expectations about near-term BSP policy direction,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore.

Stable Peso

Under Medalla’s watch, the central bank has managed to keep stability in the local currency market after the peso briefly slumped to a record-low 59 against the dollar in October 2022. He also advocated for sustainable finance and broader use of digital payments. He was among the leading voices that opposed an initial sovereign wealth fund plan, which he backed after changes.

During an interview with Bloomberg TV on May 19, Medalla said he hasn’t heard anything about a possible reappointment, while adding that “it’s a pleasure to serve.”

Appointing Medalla or anyone who will continue his policy stance will help preserve the BSP’s credibility, said Galvin Chia, currency strategist at NatWest Markets in Singapore. This credibility “will be easy to lose if markets suspect that a new governor will be less hawkish on inflation and the disinflationary process,” he said.

Still, a change in the central bank’s leadership may suit the Philippines in the long term amid subdued economic prospects, said Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics Ltd. The Philippine economy’s growth slowed last quarter, but still beat expectations.

“We’ve been arguing since late last year that the BSP’s aggressive rate hiking cycle is overkill, given that most of the inflationary pressure has been a supply-side issue,” said Chanco, adding that monetary tightening was “relatively ineffectual.”

Marcos will also fill three other vacancies in the BSP’s seven-member monetary board, with the terms of Peter Favila, Antonio Abacan Jr. and Eli Remolona set to end.

--With assistance from Ditas Lopez.

Author: Andreo Calonzo and Karl Lester M. Yap