Poland’s central bank unexpectedly halted its easing cycle in the first decision since the country’s pro-European opposition, which has been critical of Governor Adam Glapinski, secured a majority in last month’s election.

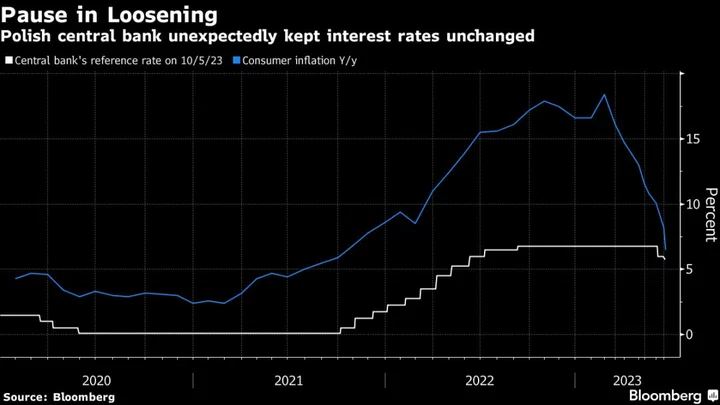

The move to keep the main interest rate at 5.75% defied expectations from a majority of economists, who predicted a third consecutive cut, and buoyed the zloty. It came as declining inflation remains above target — and the opposition under Donald Tusk prepares to take power after eight years of nationalist rule.

Glapinski fanned expectations that rate cuts will continue. He said last month that borrowing costs were “still high.” Critics have accused the governor of seeking to help the ruling party win the Oct. 15 election after he delivered an unexpectedly steep reduction in September, which wrong-footed the markets and sent the zloty into a tailspin.

“Politics most likely once again played a key role in monetary policy decision,” said Piotr Matys, an analyst at InTouch Capital Markets Ltd, who predicted the rate would stay unchanged. Glapinski will explain the decision at a news conference at 3 p.m. in Warsaw on Thursday.

The uncertainty about the inflation impact of future fiscal policy as well as regulatory policies was an argument behind the rates decision, the central bank said in a statement on Wednesday. At the same time, the new staff forecast pointed to lower inflation next year than projected in July, before the rate cuts began.

Investors and economists will closely follow Glapinski’s comments for any change in tone following the election. Before the ballot, the governor — a Law & Justice ally and critic of the opposition — said potential political instability after the vote could have a “very negative” impact on Poland’s ratings.

The mistrust is mutual, with the opposition planning to probe Glapinski over his actions amid the biggest spike in inflation in nearly a quarter century. Consumer-price growth peaked at 18.4% in February and dropped to 6.5% in October, still well above policymakers’ medium-term target.

The zloty gained the most among emerging-market currencies following the ruble on Wednesday, appreciating to the highest level since Oct. 18. BNP Paribas economist Wojciech Stepien said the move may be the start of an “extended pause” in the easing cycle. This bolsters the case for investing in the zloty even as the currency hovers near three year highs.

Derivatives showing bets on Polish interest rates in three months jumped 19 basis points on Wednesday to the highest level since before Glapinski’s rate cut in September.

Warsaw’s WIG20 equity index remained in the red, although banking stocks recouped losses on the news, which bodes well for lenders’ profit. The yield on 2-year government notes increased 6 basis points.

“This is a surprise,” Monika Kurtek, chief economist at Bank Pocztowy SA, said about the decision. “There is a lot of uncertainty: the new government will likely be formed as late as in December; it’s unclear what will happen to electricity and food prices and how this impacts inflation.”

--With assistance from Konrad Krasuski, Maciej Martewicz, Piotr Bujnicki and Mark Sweetman.

(Updates with an central bank comment from the fifth paragraph.)