A Bank of Japan policy board member saw the achievement of sustainable 2% inflation clearly in sight, according to a summary of views from the July meeting.

The summary on Monday showed the BOJ had boosted flexibility to its yield curve control program amid high uncertainties over growth and prices. Another board member struck a more cautious tone, saying that hitting the inflation target has yet to come in sight, and there’s a long way before revising the bank’s negative interest policy. Several members also said that monetary easing should be maintained.

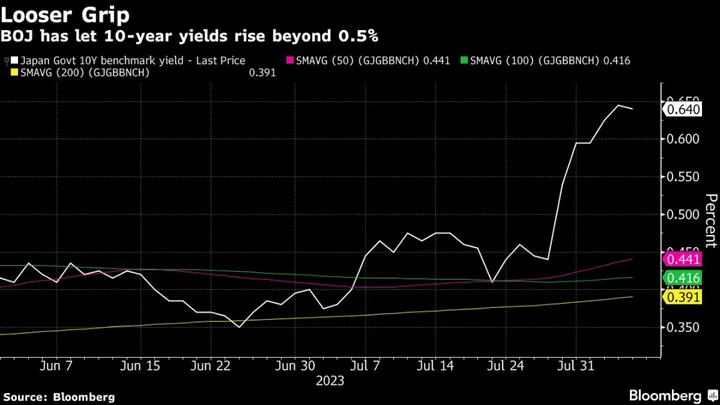

At the meeting on July 27 and 28, the BOJ eased its grip on Japanese government bond yields, allowing the 10-year yield to rise above its 0.5% ceiling, up to 1%. BOJ Governor Kazuo Ueda said the adjustment was not a step toward policy normalization, as the achievement of 2% stable inflation accompanied with wage growth has yet to come in sight.

Though still a minority opinion, the one view seeing the bank’s target clearly come into sight suggests further progress toward the BOJ achieving its goal. Still, Deputy Governor Shinichi Uchida emphasized last week that the central bank is still far from reaching an exit from its current policy framework, and from raising its negative interest rate.

In the summary of opinions, which doesn’t clarify who said what, one board member also said it’s important for the BOJ to give consideration to market functioning, as some investors have held back from investing in bonds due to high uncertainties. Another said it’s important to let interest rates be set by the market as much as possible, recover market liquidity and prevent sharp fluctuations in interest rates.

The BOJ stepped into the bond market twice last week to limit a rise in yields, underscoring its determination to curb sharp moves in rates even as it makes room for them to increase.

For now, a Bloomberg survey conducted after the policy tweak showed BOJ watchers largely don’t expect any further policy change from the central bank this year.

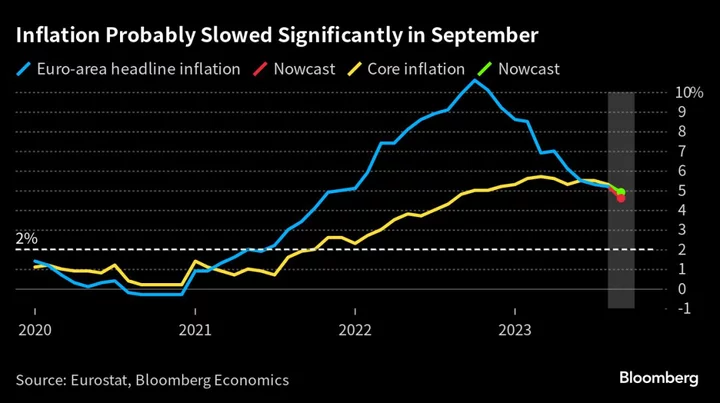

At the July meeting, the BOJ raised its inflation forecast to 2.5% for the current fiscal year while it expects inflation to slow back below its 2% target in fiscal 2024 and 2025. The bank’s benchmark inflation gauge stood at 3.3% in June.