Oil’s march toward $100 a barrel remained on pause as a rapidly tightening market was balanced concerns that central banks will keep interest rates higher for longer.

West Texas Intermediate was steady near $90 a barrel after slipping 0.4% on Monday. Macroeconomic headwinds — including the risk of elevated interest rates that have helped push the dollar to its strongest this year — are tempering signs of supply scarcity including hefty premiums for some physical crude cargoes and prompt timespreads near the widest in a year.

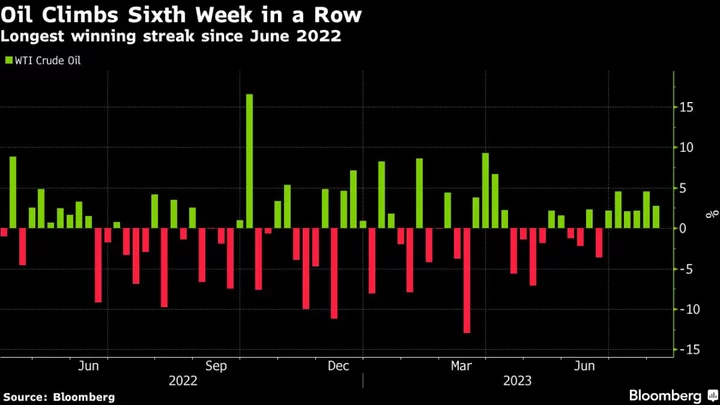

Oil has surged 27% since end-June on the back of supply curbs from OPEC+ leaders Saudi Arabia and Russia, and is set for its biggest quarterly gain since early 2022. That’s rekindled talk of $100-a-barrel crude but the rally has lost momentum over the past week amid concerns about the macro backdrop.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.