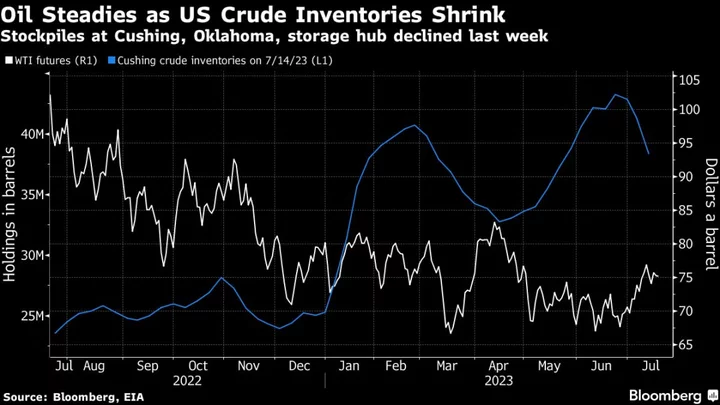

Oil steadied as persistent demand concerns were offset by declines in crude stockpiles in the US.

West Texas Intermediate traded above $75 a barrel, after dropping by 0.5% on Wednesday. Nationwide inventories fell with stockpiles at the Cushing, Oklahoma, storage hub shrinking by the most since October 2021, according to official data. However, that was tempered by a second weekly drop in demand for the main refined products: gasoline, distillates and jet fuel.

The recent revival in the US dollar, following a slump last week, added to the bearishness for oil, with commodities priced in the currency more expensive for most buyers. Crude has traded in a narrow range this week, and is still marginally down this year, after making a sharp break higher since late June on signs the market may finally be tightening.

China’s efforts to revive growth, ranging from lower interest rates, easier access to credit and a series of measures to kick-start the moribund housing market have done little to bolster the economy of the biggest crude importer. The latest signal that Beijing was seeking to boost corporate confidence came late Wednesday, with a joint pledge by the Communist Party and the government to improve conditions for private businesses.

Gains earlier this week were reversed because of dollar strength, while the inventory report had a limited impact, said Charu Chanana, a market strategist for Saxo Capital Markets Pte. in Singapore. China remains in focus, she said, with traders assessing the ramifications of the central bank’s decision to keep lending rates unchanged.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.