Oil steadied — after falling the most in a week on Monday — as Chinese measures to aid its property market improved the demand outlook.

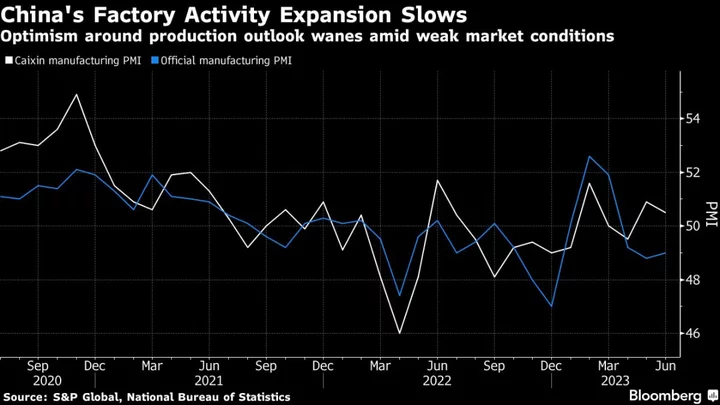

West Texas Intermediate traded above $73 a barrel after closing 1.2% lower in the previous session. Chinese regulators stepped up pressure on financial institutions to ease terms for property firms by encouraging negotiations to extend outstanding loans. The nation’s ailing real-estate sector and sluggish economic recovery has weighed on commodities this year.

Crude remains about 9% lower this year, with resilient supply from producers including Russia and Iran adding to the pressure on benchmark futures. The cost of Russian oil at one of its Western ports has crept higher recently and was closest to the price cap implemented after its invasion of Ukraine.

Interest-rate hikes by central banks has been another headwind for oil, and Federal Reserve officials said Monday that policymakers will need to tighten further this year to bring inflation back to the central bank’s goal. That’s likely to keep optimism around US demand and further price gains in check.

The International Energy Agency and OPEC will provide snapshots of the market on Thursday with the release of their monthly reports. That follows measures last week by Russia and Saudi Arabia to cut supply to prop up oil prices.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.