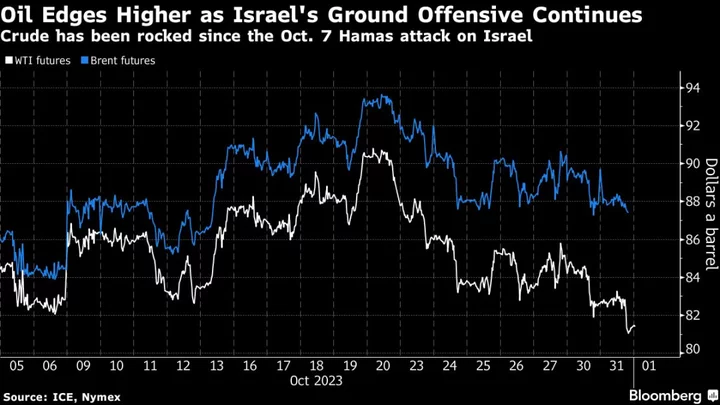

Oil steadied in Asia after a big decline in US crude stockpiles provided some optimism for a market weighed down by demand concerns.

West Texas Intermediate traded near $69 a barrel after closing 2.8% higher in the previous session. Crude inventories shrunk by 9.6 million barrels last week, the largest draw in more than a month, according to the Energy Information Administration. Gasoline demand also surged to the highest since 2021.

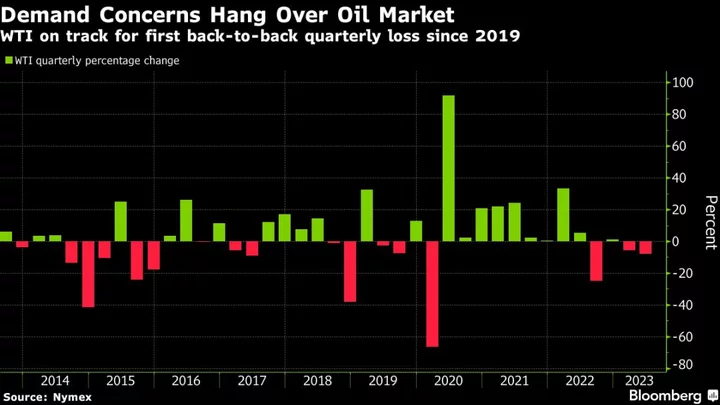

The US benchmark is still on track for its first back-to-back quarterly decline since 2019 as China’s lackluster economic recovery and aggressive monetary tightening by the Federal Reserve weighed on prices. Supply has also been plentiful, bolstered by resilient exports from Russia, despite sanctions.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.