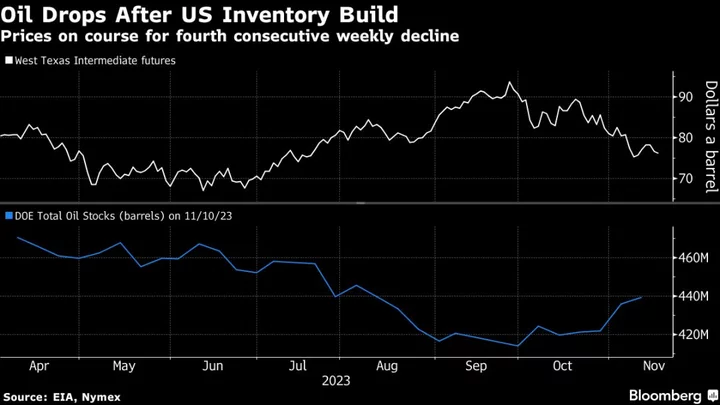

Oil declined as a rise in US inventories pointed to loosenr near-term market conditions, with prices at risk of a fourth weekly drop.

West Texas Intermediate fell toward $76 a barrel after losing 2% on Wednesday, while global benchmark Brent traded below $81. Energy Information Administration data confirmed that oil stockpiles hit the highest level since August, including a build at the key hub in Cushing, Oklahoma.

Crude trading has been buffeted by conflicting signals over recent weeks, with prices sinking to a three-month low last Wednesday before staging a modest recovery. The International Energy Agency said on Tuesday that production growth means markets won’t be as tight as had been expected this quarter, while OPEC on Monday highlighted robust demand trends. At the same time, traders expect cartel leader Saudi Arabia to prolong a supply cut.

The focus is turning to a weaker outlook, said Charu Chanana, a market strategist at Saxo Capital Markets Pte, citing inventory and macro data. Even an extension of Saudi Arabia’s cut could fail to entice speculators, she added.

The EIA data did show some ambiguity, with a drawdown in US product inventories signaling stronger demand for gasoline, diesel and jet fuel, which would boost crude consumption. In addition, implied gasoline consumption rose, although it remains below the five-year seasonal average.

Still, signs of softness are evident along the oil futures curve. The spread between WTI’s two nearest contracts has flipped back to contango — where near-term prices are below longer-dated ones — and the second-third month differential has followed suit in an indication that conditions are loosening.

Meanwhile, President Joe Biden’s energy security adviser, Amos Hochstein, said the US will enforce sanctions on more than 1 million barrels a day of oil exports from Iran amid the conflict in the Middle East. A resurgence in flows from Venezuela after the easing of US curbs could help offset any supply losses, with Vitol Group hiring a supertanker to load oil from the Latin American nation.

Terminal users can click here for more on the Israel-Hamas War.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.