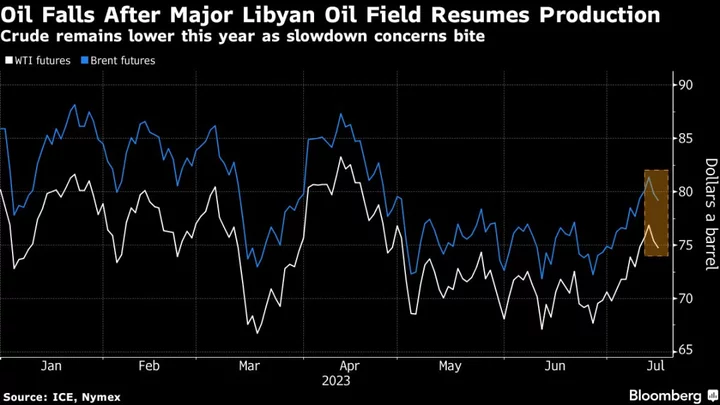

Oil fell for a second session as a major Libyan field resumed output after protesters that shut the facility ended their demonstration.

Global benchmark Brent dropped toward $79 a barrel, after easing by 1.8% on Friday. One of Libya’s biggest oil fields, Sharara, was resuming production after the demonstrators left the site, a person familiar with the matter said. Before last week’s disruption, it was producing about 250,000 to 260,000 barrels a day.

Crude has rallied over the past three weeks but remains marginally lower this year as top importer China’s lackluster economic recovery and the Federal Reserve’s campaign of monetary tightening weighed on demand. Fed officials are expected to raise borrowing costs again this month, and have signaled they’re still open to further increases.

There are some signs the market is finally tightening this half, with OPEC+ linchpins Saudi Arabia and Russia both reducing crude exports. Those curbs, along with the outages in Libya and an ongoing supply disruption in Nigeria, had helped Brent to briefly exceed $80 a barrel last week.

Oil’s recent rise has meant that the price of Urals crude exported from Russia has exceeded the $60 price cap set by the Group of Seven to curb Moscow’s oil revenue. That’s likely to add banking and shipping woes to buyers of the oil including India and China, with one protection and indemnity provider already flagging possible delays from financial and technical service providers.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.