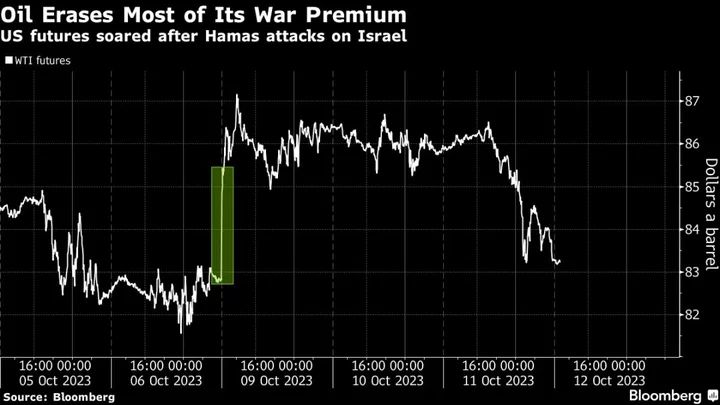

Oil was little changed after erasing most of the surge following Hamas’ attacks on Israel over the weekend.

West Texas Intermediate traded near $83 after dropping on Wednesday following a New York Times report that US intelligence shows Iran was surprised by Hamas’s attack on Israel. That may reduce the chances of additional sanctions on Iranian oil and help prevent the nation and its proxies across the Middle East from being drawn into the conflict.

The industry-funded American Petroleum Institute reported a large increase in stockpiles, according to people familiar with the data. However, inventory at Cushing, Oklahoma — the delivery point for WTI — was seen resuming drops toward critically low levels after a small increase last week. Official data is due later on Thursday, as well monthly oil market reports from OPEC and the International Energy Agency.

Oil’s gains this week have been curbed by OPEC+ leader Saudi Arabia on Tuesday reiterating support for the group’s efforts to balance oil markets. Record-high US production and the possibility of a deal between the US and Venezuela have also helped ease concerns about supply tightness. Prices are still marginally higher this year following a surge last quarter after Saudi Arabia and Russia curtailed production.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.